AI Trading Bots: Top 10 Day Traders, Virtual Accounts, on November 27, 2024

Financial markets are constantly evolving, and day traders are at the forefront of this dynamic environment, seeking profitable opportunities amidst market volatility. The integration of Financial Learning Models (FLMs) and technical analysis has become a cornerstone of modern trading strategies. By leveraging advanced artificial intelligence and data-driven insights, traders can better navigate unpredictable markets and refine their approaches to buying and selling.

This article explores innovative day trading strategies supported by FLMs, highlighting specific techniques and the role of Tickeron’s platform in empowering traders with cutting-edge tools.

Day Trader: Price Action Bot for Active Trading ($10K per Position) (TA)

Active trading demands quick decision-making and precise execution. The Price Action Bot for active trading focuses on analyzing price movements in real time, helping traders identify short-term opportunities. By allocating $10,000 per position, this strategy leverages technical analysis (TA) to identify patterns such as breakouts, pullbacks, and reversals.

The bot integrates historical data with live market updates, making it an ideal companion for traders who prioritize agility. By setting predefined criteria for entry and exit, the bot minimizes emotional decision-making. Moreover, it helps traders maintain discipline, a critical factor in consistently capitalizing on price action strategies.

For traders operating in high-liquidity markets, this bot can mitigate risks associated with overtrading, while providing actionable insights to fine-tune their trades.

Day Trader: Price Action Bot for High Volatility Stocks ($15K per Position) (TA)

Trading high-volatility stocks requires a specialized approach, as price swings can be both opportunities and pitfalls. The Price Action Bot for high-volatility stocks focuses on managing positions worth $15,000. This bot utilizes TA to track momentum indicators and support/resistance levels, ensuring traders maximize profits while safeguarding against abrupt losses.

High volatility often leads to unpredictable market behavior, making it essential to have tools that can swiftly adapt to shifting conditions. This bot excels at analyzing spikes and dips, empowering traders to capitalize on intraday opportunities. By combining real-time data with predictive analytics, the bot offers a comprehensive framework for navigating volatile environments.

Day Trader: Optimizing Dip Buying in Volatile Markets with Strategic Stop Losses ($6.5K per Position) (TA)

Dip buying is a time-tested strategy that involves purchasing stocks during temporary price declines, aiming to profit from subsequent recoveries. However, executing this strategy in volatile markets can be challenging. This bot focuses on dip buying with positions worth $6,500, incorporating strategic stop losses to minimize downside risk.

By identifying oversold conditions using indicators like the Relative Strength Index (RSI) and Moving Averages (MAs), the bot pinpoints optimal entry points. Furthermore, it implements dynamic stop-loss orders, which adjust based on market conditions, ensuring losses are capped without prematurely exiting winning trades.

This strategy is particularly effective in markets prone to sharp reversals, offering traders a structured method to exploit temporary price anomalies.

Day Trader: Trend-Seeking Bot for Medium Volatility Stocks ($6.5K per Position) (TA)

Trends are the backbone of many profitable trading strategies, and medium-volatility stocks often present lucrative opportunities for trend-followers. The Trend-Seeking Bot, designed for $6,500 positions, uses TA to identify and follow established price trends.

This bot relies on indicators such as Moving Average Convergence Divergence (MACD), Bollinger Bands, and volume analysis to confirm trends before initiating trades. By focusing on medium-volatility stocks, it balances risk and reward, making it a viable option for traders looking to diversify their portfolios.

The bot’s ability to adapt to changing trends ensures it remains effective across various market cycles, providing traders with consistent results.

Day Trader: Price Action Bot for Medium Volatility Stocks ($7.5K per Position) (TA)

Medium-volatility stocks often strike a balance between risk and reward, offering steady opportunities for day traders. The Price Action Bot, tailored for $7,500 positions, employs TA to analyze market movements and execute trades based on well-defined criteria.

This bot focuses on short-term patterns, such as candlestick formations and intraday support/resistance levels. Its precision-driven approach helps traders avoid overexposure, a common pitfall in medium-volatility markets.

By leveraging predictive analytics, the bot minimizes the guesswork associated with trading, enabling traders to make data-backed decisions. This ensures consistency in executing strategies, even in complex market conditions.

Day Trader: Dip Buying Tactics in High Volatility Stocks and Long Only ($5K per Position) (TA)

High-volatility stocks often experience sharp declines followed by rapid recoveries, creating ideal conditions for dip buying. This strategy, focusing on $5,000 positions, is optimized for long-only trades, meaning it avoids short-selling altogether.

The bot uses TA to detect price drops that are likely to recover quickly. Indicators such as stochastic oscillators and Bollinger Bands are employed to identify oversold conditions. By maintaining a long-only focus, this bot aligns with traders who prefer to avoid the complexities and risks of short selling.

The inclusion of stop-loss mechanisms ensures that traders can limit their exposure during prolonged downtrends, making this strategy effective in both bull and bear markets.

Day Trader: Targeting Dips in Medium Volatility Stocks ($10K per Position) (TA)

For traders looking to profit from medium-volatility stocks, dip-buying strategies remain a reliable choice. This bot targets dips with $10,000 positions, leveraging TA to pinpoint optimal entry points.

Medium-volatility stocks often exhibit predictable price behavior, allowing the bot to capitalize on temporary declines. It employs RSI and Fibonacci retracements to gauge oversold levels, ensuring traders enter positions with favorable risk-reward ratios.

By focusing on disciplined execution, the bot reduces the emotional aspect of trading, helping traders maintain a systematic approach. Its user-friendly interface and real-time updates make it an indispensable tool for day trading.

Day Trader: Targeting Dips in High Volatility Stocks ($6.5K per Position) (TA)

High-volatility stocks offer significant profit potential, but they also come with heightened risks. This bot targets dips in such stocks with $6,500 positions, using TA to identify low-risk entry points.

By analyzing price movements and volume data, the bot ensures traders are well-positioned to capitalize on sharp recoveries. It incorporates advanced risk management tools, including stop-loss orders and trailing stops, to safeguard investments.

The bot’s adaptability to sudden market changes makes it a powerful ally for traders looking to navigate high-volatility environments with confidence.

Tickern and Financial Learning Models (FLMs)

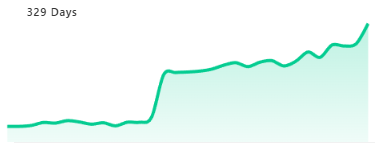

Tickeron, a pioneer in integrating FLMs with trading strategies, offers a comprehensive platform that empowers traders of all experience levels. Sergey Savastiouk, Ph.D., CEO of Tickeron, emphasizes the synergy between FLMs and technical analysis as a game-changer in stock trading.

By processing vast amounts of data, FLMs identify patterns and insights that are often invisible to human traders. This enhances decision-making, particularly in volatile markets, where rapid responses are critical. Tickeron’s AI-driven tools enable traders to refine their strategies, optimize gains, and mitigate risks.

Conclusion

The integration of Financial Learning Models with technical analysis is revolutionizing day trading. By offering tailored strategies for various market conditions, tools like Tickeron’s FLMs provide traders with a competitive edge. From price action bots to dip-buying strategies, these innovations enable traders to navigate market volatility with precision and confidence.