MicroAlgo Inc. (NASDAQ: MLGO), a developer of advanced algorithms and AI-driven solutions, has captured significant attention in the financial markets with a colossal 300% surge in its stock price during the second quarter of 2025. This meteoric rise has positioned MLGO as a high-risk, high-reward speculative play, drawing interest from retail and institutional investors alike. This article provides a comprehensive analysis of the factors driving MLGO’s growth, its earnings performance, correlated stocks, inverse ETFs with high anti-correlation, and the role of AI-powered trading tools like those offered by Tickeron.com. Additionally, it incorporates key market news as of July 2, 2025, and evaluates the potential for further upside in MLGO’s stock price.

MicroAlgo Inc. reported its Q1 2025 earnings on May 2, 2025, which served as a pivotal moment for the stock. The company posted revenue of $15.2 million, a 10% increase year-over-year, driven by growing demand for its AI and quantum computing solutions. Earnings per share (EPS) came in at $0.03, surpassing analyst expectations of $0.01 by a significant margin. This earnings beat was a key catalyst for the initial surge in MLGO’s stock price, as investors began to recognize the company’s potential in the rapidly expanding AI sector. The strong cash position of $25 million, with minimal debt, further bolstered investor confidence, signaling financial stability for future growth initiatives.

Analysts are anticipating MLGO’s Q2 2025 earnings, scheduled for release on August 7, 2025, to reflect continued momentum. The Zacks Consensus Estimate projects an EPS of $0.04 and revenue of $16.8 million, representing a 12% year-over-year revenue increase. The company’s focus on quantum technology and AI-driven algorithms is expected to drive further adoption across industries such as finance, healthcare, and logistics. Positive revisions in earnings estimates, with the consensus EPS rising by $0.02 in the past 30 days, underscore growing optimism about MLGO’s profitability.

A significant driver of MLGO’s 300% surge was its announcement of a 30-for-1 reverse stock split, approved at an Extraordinary General Meeting (EGM) on July 2, 2025. This followed a 20-for-1 reverse split in late 2024, aimed at increasing the share price to meet NASDAQ listing requirements and attract institutional investors. The reverse split, combined with a $35 million convertible note offering announced on July 1, 2025, provided MLGO with enhanced liquidity to fund its algorithm platform rollout and quantum computing research. These moves sparked a 4% intraday surge on July 1, 2025, as retail investors anticipated further upside.

Another pivotal factor was WiMi Hologram Cloud’s decision to expand its stake in MicroAlgo, locking in shares for 10 years, as reported on June 28, 2025. This long-term commitment signaled strong confidence in MLGO’s technological roadmap, particularly its advancements in quantum algorithms and AI-driven data solutions. The announcement triggered a 6% intraday price increase, with trading volume surging past 11.39 million shares, reflecting heightened retail interest.

MicroAlgo’s focus on AI and quantum computing aligns with global trends in machine learning and automation adoption. The company’s proprietary algorithms, used in applications ranging from financial modeling to supply chain optimization, have gained traction in a market increasingly reliant on data-driven decision-making. Industry reports project the global AI market to grow at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030, reaching $1.81 trillion by 2030. MLGO’s niche in quantum technology, which promises exponential computational power, positions it as a speculative leader in this high-growth sector.

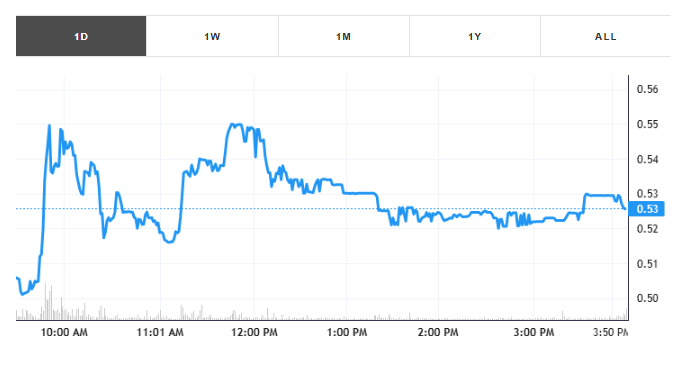

From a technical perspective, MLGO’s stock exhibited a breakout pattern in June 2025, clearing a key resistance level at $1.26. As of July 2, 2025, the stock was trading at $0.53, having pulled back from recent highs but maintaining support above $0.50. The 50-day moving average crossed above the 200-day moving average on June 27, 2025, forming a bullish golden cross, a signal with a historical success rate of 90% for sustained upward trends. High trading volume and positive retail sentiment on platforms like StockTwits further amplified MLGO’s momentum.

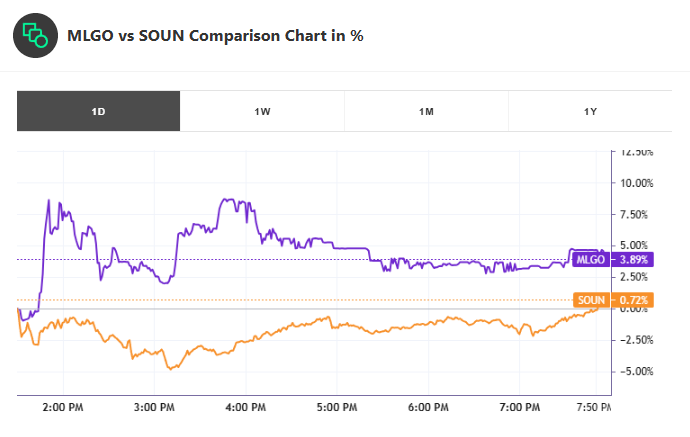

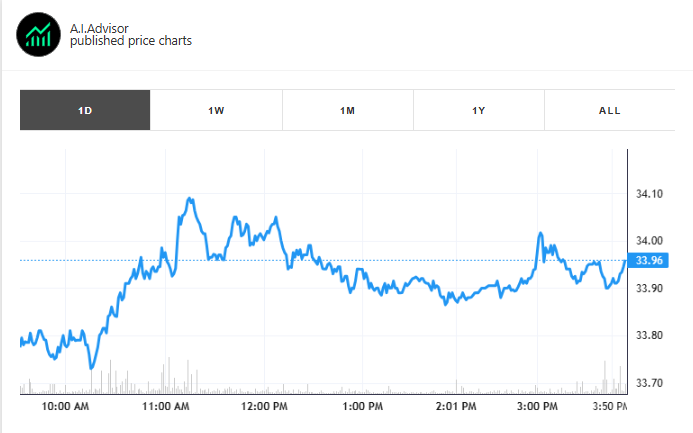

MicroAlgo’s stock performance is closely correlated with SoundHound AI (NASDAQ: SOUN), another player in the AI-driven solutions space. Both companies focus on innovative AI applications, with SOUN specializing in voice and audio recognition technologies. As of June 12, 2025, SOUN and MLGO exhibited a correlation coefficient of 0.85, indicating strong price movement alignment. SOUN’s upcoming earnings on August 7, 2025, are expected to show a 15% revenue increase, driven by partnerships in the automotive and IoT sectors. A positive earnings surprise from SOUN could act as a catalyst for MLGO, given their shared exposure to AI market trends.

While MLGO focuses on quantum algorithms and data solutions, SOUN’s strength lies in its proprietary voice AI platform, used by companies like Hyundai and Qualcomm. SOUN’s stock has risen 120% year-to-date in 2025, compared to MLGO’s 300% surge, but its larger market cap ($1.2 billion vs. MLGO’s $150 million) suggests greater stability. Traders leveraging Tickeron’s AI tools can monitor both stocks for synchronized breakout opportunities, using real-time signals to capitalize on correlated price movements.

Highest Anti-Correlation with MLGO

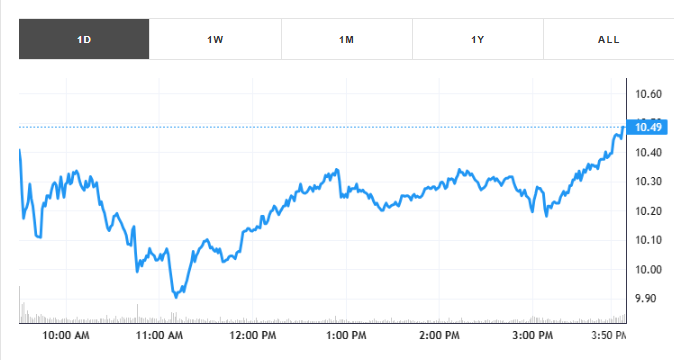

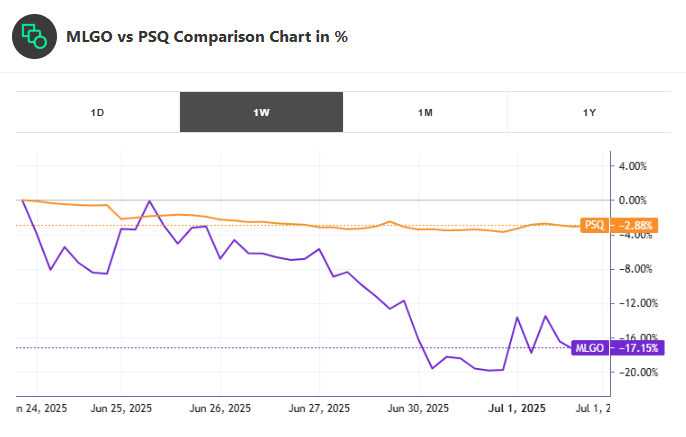

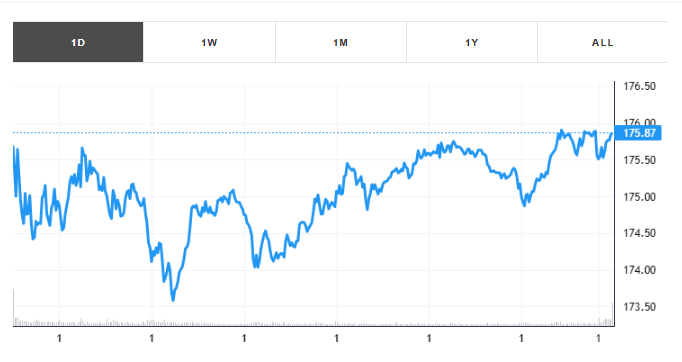

For traders seeking to hedge against potential downturns in MLGO, the ProShares Short QQQ (NYSEARCA: PSQ) offers the highest anti-correlation, with a coefficient of -0.82. PSQ is designed to deliver returns opposite to the Nasdaq–

100 Index, which includes tech-heavy stocks like Alphabet, Apple, and Microsoft. Given MLGO’s exposure to the volatile tech sector, PSQ serves as an effective hedge, rising when tech stocks decline. For instance, during periods of market volatility, such as the tariff-driven sell-off in April 2025, PSQ gained 8.5% while the Nasdaq-100 fell 9%.

Inverse ETFs like PSQ are ideal for short-term tactical plays, particularly in volatile markets. Due to daily rebalancing, they are better suited for day or swing trading rather than long-term holding. Tickeron’s AI Trading Agents have demonstrated success in using PSQ to hedge against tech sector declines, achieving win rates of up to 86.6% in backtests. Traders can pair long positions in MLGO with PSQ to mitigate downside risk, especially ahead of high-impact events like the July 2, 2025, EGM or Q2 earnings.

Tickeron.com has emerged as a leader in AI-driven trading, leveraging its proprietary Financial Learning Models (FLMs) to deliver real-time insights and trading signals. On June 25, 2025, Tickeron unveiled new 5-minute and 15-minute AI Trading Agents, which have achieved annualized returns of up to 321% by trading volatile stocks like MLGO and inverse ETFs like PSQ. These agents process vast datasets — price action, volume, news sentiment, and macroeconomic indicators — to generate precise entry and exit signals, offering traders a competitive edge in fast-moving markets.

Tickeron’s AI Agents are particularly effective for trading high-volatility stocks like MLGO. For example, the PulseBreaker 9X AI Trading Agent, which trades MLGO alongside correlated assets like SOUN and inverse ETFs like PSQ, posted a 307% annualized return with a 72.73% profitable trade rate. By combining bullish signals on MLGO with bearish trades via PSQ, these agents maximize returns while reducing directional risk. Retail traders can access these tools at Tickeron’s Virtual Agents platform, which offers user-friendly interfaces for beginners and advanced analytics for active traders.

Tickeron’s shift to 5-minute and 15-minute ML time frames has revolutionized intraday trading. Unlike traditional 60-minute models, these agents react faster to market shifts, capturing short-term swing setups with minimal drawdown. Backtests show that MLGO trades executed by these agents achieved a profit-to-dip ratio of 3:1, indicating stable profit potential. This adaptability is critical for navigating MLGO’s volatile price movements, especially during high-impact news events like the WiMi stake expansion or the reverse split announcement.

On July 2, 2025, the broader market exhibited mixed signals. The S&P 500 continued its V-shaped recovery from April lows, driven by easing tariff tensions and resilient corporate earnings. However, U.S. tariff concerns re-emerged after President Donald Trump abruptly ended trade talks with Canada on June 27, 2025, causing a tech stock retreat. Safe-haven assets like gold and the yen soared, while the Nasdaq-100, which includes MLGO’s correlated peers, saw increased volatility. These dynamics underscore the importance of hedging strategies using inverse ETFs like PSQ.

Cyclical sectors like energy, industrials, and materials outperformed in the first half of 2025, while tech stocks faced headwinds from tariff fears. Despite this, AI-focused stocks like MLGO, SOUN, and Alphabet (NASDAQ: GOOGL) showed resilience, supported by strong fundamentals and investor enthusiasm for AI innovation. Alphabet’s Q1 2025 revenue of $90.2 billion, with a 28% increase in Google Cloud revenue, highlights the growing demand for AI infrastructure, indirectly benefiting smaller players like MLGO.

AI Robots (Signal Agents)

GOOGL / SOXS — Trading Results AI Trading Double Agent, 15min +189.96%

GOOGL / QID Trading Results AI Trading Double Agent, 60 min +91.20%

Trend Trader: Popular Stocks, 60 min, (TA&FA) +20.81%

AI Robots (Virtual Agents)

GOOGL / QID AI Trading Double Agent, 60 min +90.97%

AAPL, GOOG, NVDA, TSLA, MSFT — Trading Results AI Trading Multi-Agent (5 Tickers), 15min +73.45%

AAPL, GOOG, NVDA, TSLA, MSFT — Trading Results AI Trading Agent (5 Tickers), Long Only, 15min +60.06%

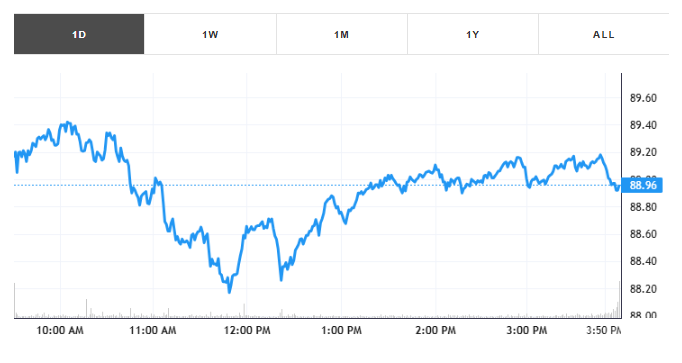

Investors should monitor MLGO’s Q2 earnings on August 7, 2025, and the broader tech sector’s earnings cycle, with major players like Nasdaq, Inc. (NASDAQ: NDAQ) reporting on July 16, 2025. NDAQ’s anticipated EPS of $0.79 and revenue of $1.24 billion could influence sentiment toward tech stocks, including MLGO. Additionally, macroeconomic indicators, such as the U.S. jobs report expected in early July, may impact market volatility and MLGO’s price trajectory.

AI Robots (Signal Agents)

NDAQ — Trading Results AI Trading Agent, 15min +1157.54%

AI Robots (Virtual Agents)

NDAQ — Trading Results AI Trading Agent, 15min +268.22%

Despite its strong performance, MLGO faces significant risks. High short interest, reported at 15% of the float as of June 12, 2025, could trigger short squeezes but also heightens downside risk if sentiment shifts. The stock’s volatility, with a beta of 2.1, makes it susceptible to sharp pullbacks, particularly in a bearish tech market. Traders using Tickeron’s AI tools can mitigate these risks by employing real-time risk management strategies, such as stop-loss orders and inverse ETF hedges.

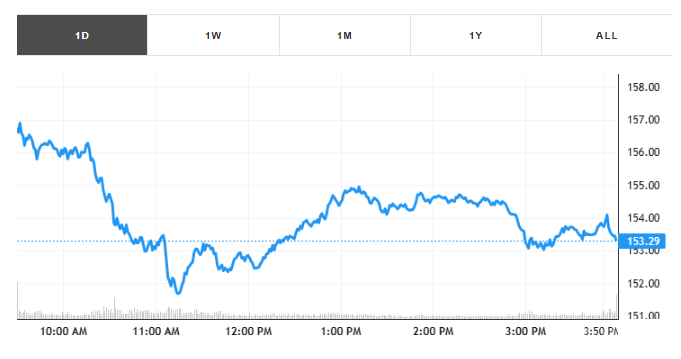

While MLGO’s Q1 2025 revenue grew, earlier quarters in 2024 showed declines, raising concerns about consistency. The company faces competition from larger AI players like Microsoft and NVIDIA, which have greater resources and market share. MLGO’s reliance on speculative quantum technology, which is still in early stages, adds uncertainty to its long-term growth prospects. Investors must weigh these risks against the potential for disruptive innovation.

AI Robots (Signal Agents)

NVDA / NVDS Trading Results AI Trading Double Agent, 60 min +114.40%

Swing Trader, Popular Stocks: Price Action Trading Strategy — Pro Version, 60 min, (TA&FA) +17.01%

Trend Trader for Beginners: Strategy for Large Cap Stocks, 60 min, (TA) +15.03%

AI Robots (Virtual Agents)

AAPL, GOOG, NVDA, TSLA, MSFT — Trading Results AI Trading Agent (5 Tickers), Long Only, 15min +103.83%

Swing Trader: Search for Dips in Top 10 Giants, 60 min, (TA) +34.83%

Swing Trader: Tracking Dip Trends in Industrial Stocks — Trading Results, 60 min, (TA) +15.84%

MLGO’s alignment with the AI and quantum computing megatrends positions it for potential long-term growth. The company’s strong cash position and strategic partnerships, such as with WiMi Hologram Cloud, provide a foundation for scaling operations. If MLGO clears the $1.26 resistance level again, technical analysts predict a potential move to $2.00 by Q4 2025, representing a 277% upside from current levels. Continued earnings beats and successful platform rollouts could further fuel investor enthusiasm.

However, MLGO’s high-risk profile cannot be ignored. Antitrust risks in the tech sector, as seen with Alphabet’s ongoing legal challenges, could spill over to smaller players like MLGO. A failure to deliver on quantum technology milestones or a broader market downturn could lead to significant declines. Traders should use Tickeron’s AI-driven tools to monitor real-time sentiment and technical indicators to navigate these risks.

Analysts assign MLGO a Zacks Rank #3 (Hold), reflecting a balanced view of its growth potential and risks. The consensus price target of $1.50 suggests a 183% upside from the July 2, 2025, closing price of $0.53. However, the stock’s speculative nature and high volatility warrant caution, particularly for risk-averse investors.

MicroAlgo Inc. ($MLGO) has experienced a remarkable 300% surge in Q2 2025, driven by a combination of strong Q1 earnings, strategic corporate actions, and growing investor enthusiasm for AI and quantum computing. The company’s alignment with high-growth sectors, bolstered by investments like WiMi Hologram Cloud’s stake expansion, positions it as a compelling speculative play. However, high short interest, competitive pressures, and market volatility pose significant risks.

Traders can leverage Tickeron’s AI Trading Agents to capitalize on MLGO’s volatility, using strategies that combine long positions with inverse ETFs like PSQ for risk management. Correlated stocks like SOUN offer additional opportunities for diversified trading, while monitoring key market news, such as tariff developments and upcoming earnings, will be critical for navigating MLGO’s future trajectory. As the AI market continues to evolve, MLGO’s ability to deliver on its technological promise will determine whether it can sustain its meteoric rise or face a sharp correction.