Regencell Bioscience Holdings (RGC), a biotech company focused on traditional Chinese medicine (TCM) and innovative therapies for neurodevelopmental disorders and infectious diseases, has captured significant attention in the financial markets in 2025. With an astonishing year-to-date gain of nearly 14,899%, RGC has emerged as one of the most explosive performers on the NASDAQ. This article delves into RGC’s market performance, key technical indicators, recent news, a comparison with a correlated stock, and the role of AI-driven tools like those offered by Tickeron in analyzing such dynamic market movements.

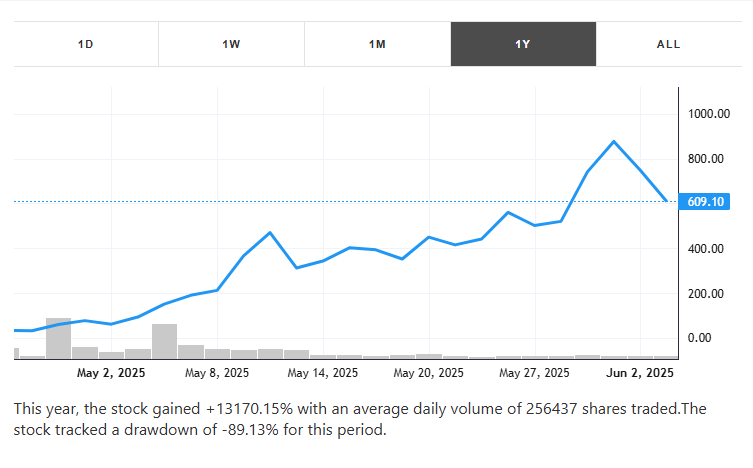

RGC’s stock has experienced a staggering surge, climbing from approximately $3.25 to highs of $950 in just a few months, as reported in posts on X. In May 2025 alone, the stock gained 894.45%, with an average daily trading volume of 87,874 shares. This remarkable performance has been driven by a combination of speculative enthusiasm, a tight float of approximately 800,000 shares, and optimism surrounding the company’s pipeline, which includes treatments for ADHD, ASD, and COVID-19. However, the company’s financials reveal challenges, with no reported revenue and a $4.3 million net loss, highlighting the speculative nature of its rally.

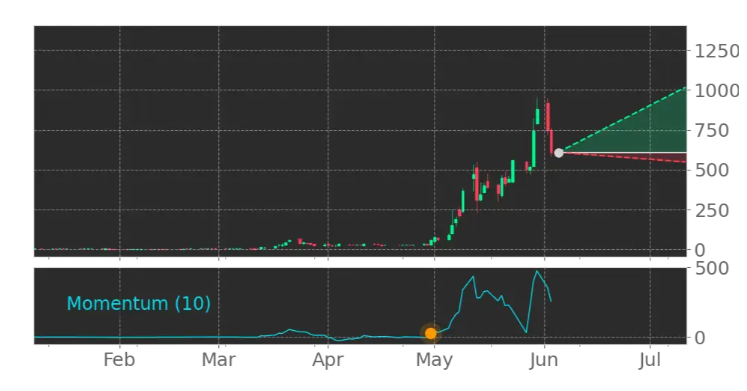

Technical analysis provides insight into RGC’s meteoric rise. On April 30, 2025, the Momentum Indicator for RGC moved above the 0 level, signaling the start of a new upward trend. According to Tickeron’s AI analysis, in 62 out of 71 similar instances (87%), the stock continued to climb following this signal, suggesting a strong probability of further gains. Additionally, RGC’s Moving Average Convergence Divergence (MACD) turned positive on the same date, reinforcing bullish sentiment. In 32 historical cases, the stock rose in the following month, indicating robust momentum.

However, caution is warranted. On May 27, 2025, the 10-day RSI Indicator moved out of overbought territory, suggesting a potential pullback. Tickeron’s AI noted that in 18 similar instances, this was a bearish signal, prompting traders to consider selling or exploring put options. Additionally, RGC broke above its upper Bollinger Band on May 5, 2025, which could indicate overextension and a possible correction as the price moves back toward the middle band.

On June 3, 2025, a significant announcement fueled further interest in RGC. The company disclosed a 38-for-1 stock split, set to take effect on June 16, 2025, pending NASDAQ approval. This move aims to boost liquidity and make shares more accessible to retail investors, potentially sustaining the stock’s upward trajectory. Posts on X highlighted this development as a catalyst for continued bullish sentiment, with some analysts projecting the stock could test the $800 level in the short term, though overbought conditions and low liquidity increase the risk of volatility.

Other news contributing to RGC’s rally includes its tightly held float, with CEO Yat-Gai Au owning approximately 81% of shares, and ongoing buying during dips, as noted in posts on X. The company’s focus on TCM and its pipeline targeting high-profile conditions has also generated buzz, despite the lack of revenue. However, the absence of clear catalysts for the stock’s 2,500% surge in under two months has led some traders to attribute the movement to algorithmic trading and speculative “vibes.”

Tickeron’s AI-driven tools have been instrumental in analyzing volatile stocks like RGC. Under the leadership of CEO Sergey Savastiouk, Tickeron’s Financial Learning Models (FLMs) combine advanced technical analysis with artificial intelligence to identify market patterns with high precision. Tickeron’s trading bots, including user-friendly options for beginners and high-liquidity stock robots, provide real-time insights into bullish and bearish signals. The platform’s Double Agents feature, for instance, allows traders to assess both sides of the market, enabling balanced decision-making. For a stock like RGC, Tickeron’s AI tools can help traders navigate its extreme volatility by identifying key entry and exit points based on technical indicators like RSI, MACD, and Bollinger Bands.

Despite its impressive gains, RGC’s rally carries significant risks. The stock’s overbought conditions, low liquidity, and lack of revenue raise concerns about sustainability. A three-day decline reported on May 23, 2025, suggested potential further downside, with Tickeron’s analysis indicating that in 62 similar cases, the stock continued to fall in the following month. Traders should remain vigilant, using tools like those offered by Tickeron to monitor real-time signals and manage risk.

Looking ahead, the upcoming stock split could enhance liquidity and attract new investors, potentially stabilizing RGC’s price action. However, the speculative nature of the stock, coupled with its dependence on pipeline developments, warrants caution. Traders leveraging AI-driven insights from platforms like Tickeron will be better equipped to navigate this high-risk, high-reward opportunity.

Regencell Bioscience Holdings (RGC) has defied expectations with its extraordinary 2025 performance, driven by speculative enthusiasm, a tight float, and strategic corporate actions like the announced stock split. While technical indicators suggest continued momentum, overbought signals and low liquidity highlight the need for caution. By leveraging Tickeron’s AI trading bots and Financial Learning Models, traders can gain a competitive edge in analyzing RGC’s volatile movements. As the biotech sector continues to evolve, RGC remains a compelling, albeit risky, case study in market dynamics.