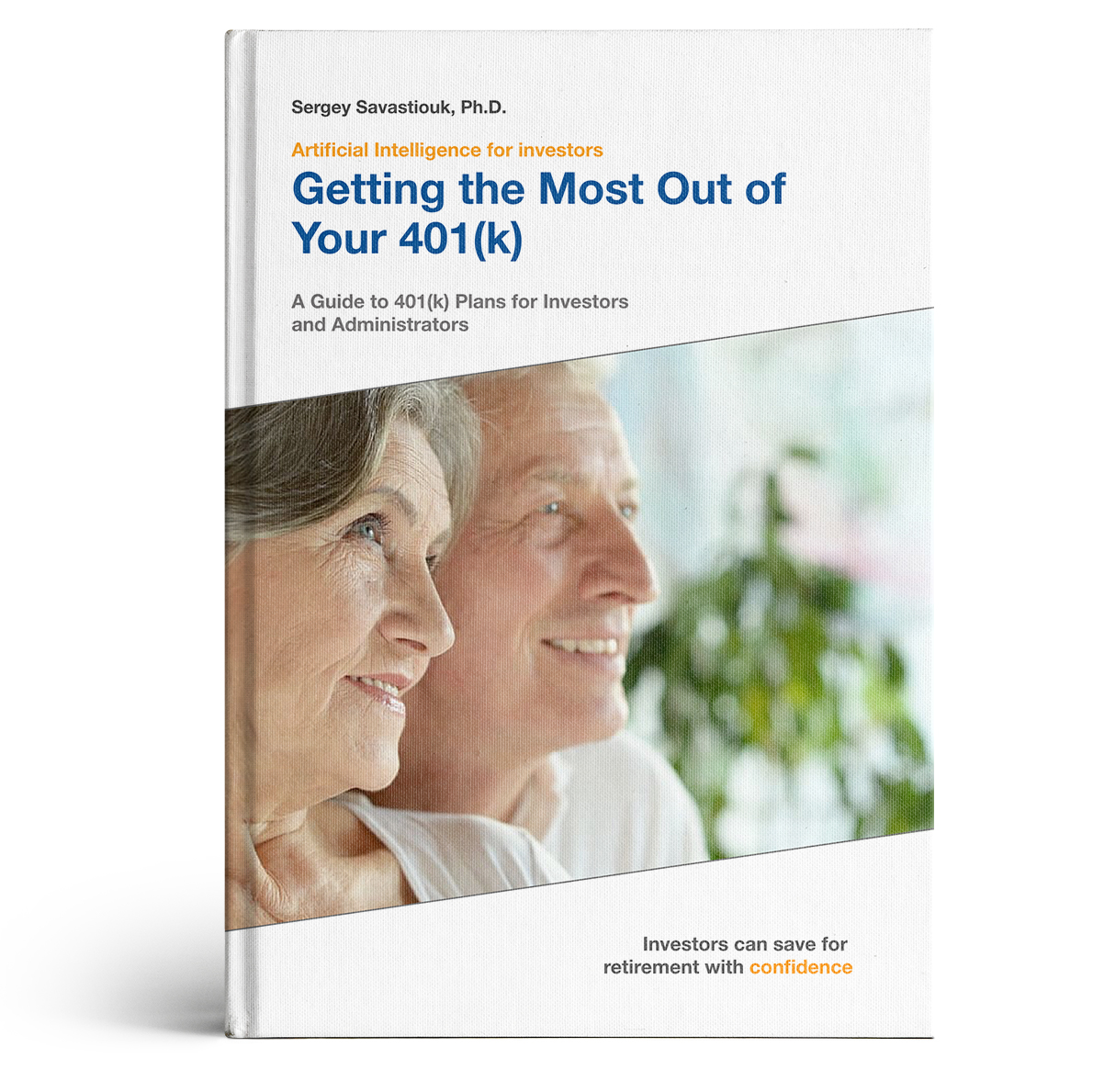

Sergey Savastiouk, Ph.D.

Artificial Intelligence For Investments and Trades

Artificial Intelligence For Investments and Trades

Ebook on 401(K)

«Getting the Most Out of Your 401(k)»

Trade Ideas with Odds of Success

Investors can save for retirement with confidence. Learn how.

Trade Ideas with Odds of Success

Investors can save for retirement with confidence. Learn how.

Table of Contents

2

Introduction

Most working Americans have heard of a 401(k) – after all, roughly 55 million Americans had an active 401(k) as of 2016, with over 555,000 companies offering plans to their employees. According to the Investment Company Institute (ICI), this equated to $5.6 trillion in retirement assets as of September 30, 2018, which represents 19% of all US retirement assets.

401(k)s remain enduringly popular for their ease of management, low cost to employers relative to pension funds, and the control (and benefits) they give investors/employees. 401(k)s are typically composed of a mixture of mutual funds, target-date funds, ETFs, and/or individual stocks, and investors can often automatically contribute pre-tax portions of their paycheck to them each month.

The advantages do not end there: 401(k)s provide incentives for savers with pre-tax contributions and tax-deferred earnings. As of 2019, the IRS set a maximum contribution of $19,000 per year (with an additional catch-up contribution limit of $6,000 for people 50 or older) – which employers may match on the employee's behalf. Plans may also include a profit-sharing initiative.

When it becomes available for an investor to make withdrawals after age 59 ½, taxes are theoretically lower for the retiree, since income is generally lower than when the person was working. Additionally, there is no age cap on contributions, as long as someone remains in the workforce. And finally, 401(k)s offer excellent protection from creditors in the event of financial difficulties.

But for all the benefits, 401(k)s aren't perfect retirement vehicles. Plans may offer limited types of investments or be structured sub-optimally; they can be expensive, by virtue of administrative costs; and they are also beholden to mismanagement. Case-in-point: all of the above limitations coalesced in a 2006 lawsuit (settled in 2015) brought by employees of Lockheed Martin, which alleged concealment of over-conservative investments, excessive fees, and other missteps that dampened investor returns. For administrators, we devote a section of this eBook to help you prevent these types of issues and to catch them before they materialize.

Fortunately, a little knowledge goes a long way, and this eBook is designed to help you understand more about YOUR 401(k) plan:

401(k)s remain enduringly popular for their ease of management, low cost to employers relative to pension funds, and the control (and benefits) they give investors/employees. 401(k)s are typically composed of a mixture of mutual funds, target-date funds, ETFs, and/or individual stocks, and investors can often automatically contribute pre-tax portions of their paycheck to them each month.

The advantages do not end there: 401(k)s provide incentives for savers with pre-tax contributions and tax-deferred earnings. As of 2019, the IRS set a maximum contribution of $19,000 per year (with an additional catch-up contribution limit of $6,000 for people 50 or older) – which employers may match on the employee's behalf. Plans may also include a profit-sharing initiative.

When it becomes available for an investor to make withdrawals after age 59 ½, taxes are theoretically lower for the retiree, since income is generally lower than when the person was working. Additionally, there is no age cap on contributions, as long as someone remains in the workforce. And finally, 401(k)s offer excellent protection from creditors in the event of financial difficulties.

But for all the benefits, 401(k)s aren't perfect retirement vehicles. Plans may offer limited types of investments or be structured sub-optimally; they can be expensive, by virtue of administrative costs; and they are also beholden to mismanagement. Case-in-point: all of the above limitations coalesced in a 2006 lawsuit (settled in 2015) brought by employees of Lockheed Martin, which alleged concealment of over-conservative investments, excessive fees, and other missteps that dampened investor returns. For administrators, we devote a section of this eBook to help you prevent these types of issues and to catch them before they materialize.

Fortunately, a little knowledge goes a long way, and this eBook is designed to help you understand more about YOUR 401(k) plan:

- Is it optimal for you and/or your company?

- Could your 401(k) plan be better?

- Are there shortcomings like high fees or too few investment options that need to be addressed?

- How should you choose investments and diversify your 401(k)?

3

Chapter 1. 401(k) Plans: What You Need to Know

What is a 401(k)?

401(k)s are employer-sponsored, defined contribution retirement plans, named after the corresponding section of the Internal Revenue Code.

Employees may choose a percentage of their salary to contribute each year, though overall contributions cannot exceed an annual amount specified by the IRS. The corresponding dollar amount, which is treated as pre-tax income, is then deducted from each paycheck and deferred to the plan.

Some employers hire professionals to manage investments on behalf of their employees, while other plans allow employees to customize their plans, choosing from a slate of investment offerings.

Employees may choose a percentage of their salary to contribute each year, though overall contributions cannot exceed an annual amount specified by the IRS. The corresponding dollar amount, which is treated as pre-tax income, is then deducted from each paycheck and deferred to the plan.

Some employers hire professionals to manage investments on behalf of their employees, while other plans allow employees to customize their plans, choosing from a slate of investment offerings.

Benefits of a 401(k)

There are many benefits to owning a 401(k). For one, they provide numerous tax advantages to the owner – since contributions are pre-tax, they lower the owner's taxable income for that tax year. All investment gains in the 401(k) are also tax-deferred, meaning they are not taxable until withdrawn from the account. This means that any withdrawn funds (assuming they are untouched pre-retirement) will potentially be taxed at a lower rate, as retirees typically earn less income than they did while in the workforce.

Then there are employer contributions – in effect, bonus money. Employers will often match contributions up to a certain percentage (usually between 3 and 6 percent of annual salary), or make a non-elective contribution to the plan on the employee's behalf. Some plans may also include a profit-sharing initiative. In any case, these contributions do not count against the $19,000 yearly limit on personal contributions decreed by the IRS.

401(k)s also allow plan owners to continue contributing past the 70½ age threshold that defines other types of retirement accounts. Account owners who remain in the workforce can continue contributing past that age at the same pre-tax rate, while also avoiding mandatory minimum distributions that feature in some IRAs.

In the unfortunate event of financial troubles, 401(k) plans can also provide a shield against creditors. While 401(k)s do not offer universal protections on this front (in federal income tax-related cases, for example), commercial creditors cannot touch them. They are protected by the Employment Retirement Income Security Act of 1974 (ERISA), which stipulates only personal assets can be used to repay personal debts; because retirement savings are not technically personal assets until they are withdrawn as income, they remain the property of the plan holder as long as they remain in the 401(k).

Then there are employer contributions – in effect, bonus money. Employers will often match contributions up to a certain percentage (usually between 3 and 6 percent of annual salary), or make a non-elective contribution to the plan on the employee's behalf. Some plans may also include a profit-sharing initiative. In any case, these contributions do not count against the $19,000 yearly limit on personal contributions decreed by the IRS.

401(k)s also allow plan owners to continue contributing past the 70½ age threshold that defines other types of retirement accounts. Account owners who remain in the workforce can continue contributing past that age at the same pre-tax rate, while also avoiding mandatory minimum distributions that feature in some IRAs.

In the unfortunate event of financial troubles, 401(k) plans can also provide a shield against creditors. While 401(k)s do not offer universal protections on this front (in federal income tax-related cases, for example), commercial creditors cannot touch them. They are protected by the Employment Retirement Income Security Act of 1974 (ERISA), which stipulates only personal assets can be used to repay personal debts; because retirement savings are not technically personal assets until they are withdrawn as income, they remain the property of the plan holder as long as they remain in the 401(k).

4

Limitations

401(k) plans are not perfect. For one, many 401(k)s are limited by design to certain types of investments. While this may be a positive for simplicity's sake, those limitations often make it difficult to develop a customized, diversified long-term plan.

Even if your 401(k) is managed by someone else, its nature requires long-term strategic management – in most cases, decades-long. The likelihood that the same person will manage the plan over its entire lifespan is low, which puts the onus on the 401(k) owner to prepare accordingly.

401(k)s are also labor intensive – and thus expensive – plans to manage. Monitoring for compliance, providing administrative and educational services, and other general maintenance costs money, and employees can bear the brunt of the expense through fees and charges. Maintenance expenses also mean that recordkeeping is often less than investor-friendly, more often presenting the minimum required by law. This can mean paying for an outside advisor to parse the details – an additional outlay that may be less than ideal.

Even if your 401(k) is managed by someone else, its nature requires long-term strategic management – in most cases, decades-long. The likelihood that the same person will manage the plan over its entire lifespan is low, which puts the onus on the 401(k) owner to prepare accordingly.

401(k)s are also labor intensive – and thus expensive – plans to manage. Monitoring for compliance, providing administrative and educational services, and other general maintenance costs money, and employees can bear the brunt of the expense through fees and charges. Maintenance expenses also mean that recordkeeping is often less than investor-friendly, more often presenting the minimum required by law. This can mean paying for an outside advisor to parse the details – an additional outlay that may be less than ideal.

Interesting Statistics

In spite of a few limitations, 401(k)s are wildly popular retirement plans. The Investment Company Institute (ICI) estimated that 401(k) plans held $5.6 trillion – or 19 percent of the $29.2 trillion in total retirement assets – in the United States as of September 30, 2018. These figures represented an increase of roughly 255 percent and 3 percent overall since 2008.

55 million Americans had active 401(k) plans as of 2016, while 555,000-plus companies offered the plans to their employees. How those employees invested their plan balances, however, was varied: at the end of 2016, an average of 67 percent had their 401(k) plan balances invested directly or indirectly in equity securities (like mutual funds and equity funds); 18 percent were involved in the equity portion of balanced funds; and only 3 percent invested in money market funds (see pie chart).

55 million Americans had active 401(k) plans as of 2016, while 555,000-plus companies offered the plans to their employees. How those employees invested their plan balances, however, was varied: at the end of 2016, an average of 67 percent had their 401(k) plan balances invested directly or indirectly in equity securities (like mutual funds and equity funds); 18 percent were involved in the equity portion of balanced funds; and only 3 percent invested in money market funds (see pie chart).

Not surprisingly, age tends to factor into asset allocation. Older participants trend conservative, focusing on fixed-income securities like bond funds, money market funds, or stable value funds, while younger participants focus on equities (like equity funds, company stock, and equity portions of balanced funds). As of 2016, there was a 21 percent difference in equity investment between participants in their twenties and sixties, at 84 percent and 63 percent of assets, respectively.

5

How to Max Out Your 401(k)

Common wisdom dictates it is ideal to max out your yearly 401(k) contribution – currently limited to $19,000 per year, or $1,583.33 per month (though there is an additional catch-up contribution limit of $6,000 for people 50 or older). After all, that means more time for interest to compound and tax breaks to accumulate.

To do so, it's important to evaluate what that $1,583.33 per month represents relative to your overall monthly pay and expenses. Account owners should track fund-related fees to get a sense of additional outlay, then take advantage of employee matching offers to maximize their contributions.

To do so, it's important to evaluate what that $1,583.33 per month represents relative to your overall monthly pay and expenses. Account owners should track fund-related fees to get a sense of additional outlay, then take advantage of employee matching offers to maximize their contributions.

Withdrawal Rules

401(k) plan withdrawal rules vary based on your employer and the type of withdrawal. It is generally advisable, however, to only consider withdrawing early in a worst-case scenario. Account participants under 59.5 years old may face a 10 percent early withdrawal penalty in addition to standard income tax on the amount withdrawn.

In some cases, investors can roll their 401(k) over into a different kind of retirement account, like a Rollover IRA or a different 401(k), while maintaining the 401(k)'s tax benefits. This could occur if the person changes jobs or leaves the job where the 401(k) was offered. It's advisable to consult with a financial professional before orchestrating any rollovers or serious changes. Regardless, experts recommend treating your 401(k) as a long-term account, leaving it untouched (apart from regular maintenance to maximize performance) until yearly mandatory minimum withdrawals (called required minimum distributions) kick in at 70 ½ years old.

In some cases, investors can roll their 401(k) over into a different kind of retirement account, like a Rollover IRA or a different 401(k), while maintaining the 401(k)'s tax benefits. This could occur if the person changes jobs or leaves the job where the 401(k) was offered. It's advisable to consult with a financial professional before orchestrating any rollovers or serious changes. Regardless, experts recommend treating your 401(k) as a long-term account, leaving it untouched (apart from regular maintenance to maximize performance) until yearly mandatory minimum withdrawals (called required minimum distributions) kick in at 70 ½ years old.

6

Other Rules and Regulations of Note

There is no vesting period to personal contributions to your 401(k), though company contributions can range from immediate to six years. Loans are allowed from most 401(k) plans, though they can be costly (especially so if the outstanding balance is due immediately, like in the event of layoffs or firing). It is possible in some cases to withdraw company stock instead of rolling a 401(k) over into an IRA – in these cases, the stock will be taxed at current value when moved into the plan, with any appreciation in and out of the plan taxed as capital gains upon sale.

**

Now that we've outlined some of the basics of 401(k) plans, we'll take a look at how to evaluate your specific 401(k) plan.

**

Now that we've outlined some of the basics of 401(k) plans, we'll take a look at how to evaluate your specific 401(k) plan.

FAQ: we answer your questions posted here

7

Chapter 2. Is Your 401(k) Plan Good Enough?

If you are reading this eBook, chances are you are one of the over 55 million Americans with a 401(k) plan – or one of the administrators at the more than 550,000 companies that offer one.

Evaluating your 401(k) plan is critical whether you are an investor or a plan administrator, and Tickeron offers the tools to do it quickly and effectively.

These are the types of questions you should be considering:

For Investors: For Administrators:

With Tickeron's A.I., you can quickly and easily answer the question: is your 401(k) good enough?

One of the flagship technologies Tickeron deploys to evaluate 401(k)s is its patented Diversification Score® methodology, which examines factors like expense ratios, fundamentals, and quality of investment options in the plan. Taken together, these metrics provide insights into the strength of a 401(k) plan.

Using this information, Tickeron can determine if plan participants with various portfolio sizes and risk tolerances are able to build well-diversified portfolios with the available investment options. If there are shortcomings in the 401(k), administrators can use this information to take proactive action to address the issues -- potentially avoiding lawsuits or other issues that may arise.

Evaluating your 401(k) plan is critical whether you are an investor or a plan administrator, and Tickeron offers the tools to do it quickly and effectively.

These are the types of questions you should be considering:

For Investors: For Administrators:

- Are these good investment options? - Are the plan fees competitive?

- Are the fees reasonable compared to other plan? - Are there sufficient investments?

- Can I properly diversify within this plan? - How does our plan stack up against?

- Are administrative costs too high? - Other available plans?

With Tickeron's A.I., you can quickly and easily answer the question: is your 401(k) good enough?

One of the flagship technologies Tickeron deploys to evaluate 401(k)s is its patented Diversification Score® methodology, which examines factors like expense ratios, fundamentals, and quality of investment options in the plan. Taken together, these metrics provide insights into the strength of a 401(k) plan.

Using this information, Tickeron can determine if plan participants with various portfolio sizes and risk tolerances are able to build well-diversified portfolios with the available investment options. If there are shortcomings in the 401(k), administrators can use this information to take proactive action to address the issues -- potentially avoiding lawsuits or other issues that may arise.

Tickeron's 401(k) Analysis: How It Works

First, Tickeron offers an overview of your 401(k) plan, touching on details and statistics related to its makeup; Tickeron uses a DOL 5500 form database, in conjunction with its "Plan Administrator Reporting Quality" measure, to smooth-out variable report quality for the best possible results.

The first page of a Tickeron-generated 401(k) analysis will show "General Statistics," which provides an overview of your 401(k) plan – offering a comprehensive, at-a-glance breakdown of employer and participant behavior, total plan cost, participation, and return rates, and other high-level data. Artificial Intelligence also ranks your plan, giving you a sense of how your company 401(k) stacks up against others.

The first page of a Tickeron-generated 401(k) analysis will show "General Statistics," which provides an overview of your 401(k) plan – offering a comprehensive, at-a-glance breakdown of employer and participant behavior, total plan cost, participation, and return rates, and other high-level data. Artificial Intelligence also ranks your plan, giving you a sense of how your company 401(k) stacks up against others.

8

General Statistics

One of the key metrics in the General Statistics section is "Total Plan Cost." This figure is crucial for investors and administrators alike, since investors tend to absorb the fees (and potentially complain about them) and since administrators tend to be on the receiving end of complaints.

At worst, complaints about high fees can lead to lawsuits, so Tickeron's analysis can help administrators understand where they stand and potentially get ahead of the issues. One widely known example was a 2006 lawsuit against Lockheed Martin, which asserted that Lockheed hid excessive fees that were ultimately shouldered by plan participants. Investors alleged that the high fees led to suboptimal investment returns.

Since employers with 401(k)s are required to administer their plans for the "sole benefit" of workers, there have been quite a few lawsuits alleging mishandling. Other common complaints relate to inadequate investment options and "self-dealing," which means the company is acting in its own interest versus employees.

Key Takeaway for Administrators: Court rulings in these cases often look at whether plan administrators followed a "prudent" decision-making process, which means running an analysis like the one offered by Tickeron may help provide additional data needed to make more informed decisions.

At worst, complaints about high fees can lead to lawsuits, so Tickeron's analysis can help administrators understand where they stand and potentially get ahead of the issues. One widely known example was a 2006 lawsuit against Lockheed Martin, which asserted that Lockheed hid excessive fees that were ultimately shouldered by plan participants. Investors alleged that the high fees led to suboptimal investment returns.

Since employers with 401(k)s are required to administer their plans for the "sole benefit" of workers, there have been quite a few lawsuits alleging mishandling. Other common complaints relate to inadequate investment options and "self-dealing," which means the company is acting in its own interest versus employees.

Key Takeaway for Administrators: Court rulings in these cases often look at whether plan administrators followed a "prudent" decision-making process, which means running an analysis like the one offered by Tickeron may help provide additional data needed to make more informed decisions.

9

Is Broad Diversification Possible in Your 401(k)?

Next, Tickeron presents its diversification analysis and findings, offering breakdowns by category.

Our Diversification Score® (DivScore®) analysis looks at the investment options available in the 401(k) and can determine whether these options provide investors of different account sizes -- with different risk tolerances -- the ability to build a diversified portfolio. This part of the analysis also takes a closer look at fees and expenses while providing fundamentals for the investment options to the investor.

For Administrators, this part of the analysis can help you follow ERISA guidelines, which put emphasis on the investor's ability to choose investment options that are suitable for them. Most of the lawsuits on 401(k)s following the Great Recession focused on investment choice (or lack thereof), so this part of the analysis is key.

Tickeron helps you evaluate the investment choices in your 401(k) by determining if every type of investor -- from conservative to moderate to aggressive -- has the opportunity to build the portfolio they need based on the investment options available in the 401(k) plan. For instance, if a 401(k) leans heavily on equity mutual funds and stocks, a conservative investor may not have great options for building a diversified portfolio - and vice versa.

The tables on the next page illustrate how the Tickeron analysis works. The analysis looks at account size, i.e., the size of the 401(k) account, and for each size range, the table looks at risk tolerance vs. time horizon, measuring whether or not investors can diversify given that criteria:

Our Diversification Score® (DivScore®) analysis looks at the investment options available in the 401(k) and can determine whether these options provide investors of different account sizes -- with different risk tolerances -- the ability to build a diversified portfolio. This part of the analysis also takes a closer look at fees and expenses while providing fundamentals for the investment options to the investor.

For Administrators, this part of the analysis can help you follow ERISA guidelines, which put emphasis on the investor's ability to choose investment options that are suitable for them. Most of the lawsuits on 401(k)s following the Great Recession focused on investment choice (or lack thereof), so this part of the analysis is key.

Tickeron helps you evaluate the investment choices in your 401(k) by determining if every type of investor -- from conservative to moderate to aggressive -- has the opportunity to build the portfolio they need based on the investment options available in the 401(k) plan. For instance, if a 401(k) leans heavily on equity mutual funds and stocks, a conservative investor may not have great options for building a diversified portfolio - and vice versa.

The tables on the next page illustrate how the Tickeron analysis works. The analysis looks at account size, i.e., the size of the 401(k) account, and for each size range, the table looks at risk tolerance vs. time horizon, measuring whether or not investors can diversify given that criteria:

Above, a score of 100% means the 401(k) has solid options for diversification, while a score below 50% means improvement is probably needed. For administrators, the more orange and red you see, the more likely you may need to take action to improve the 401(k) plan. In this example above, you can see that smaller investors have good options for diversification, but larger investors are lacking in good options to diversify.

10

Diversification Score

The next metric in Tickeron's 401(k) plan analysis is Diversification Score. Tickeron's A.I. reviews each plan to determine how good the investment options are to allow for broad diversification across different investor types. The Diversification Score is generated as a single number, calibrated from 400 to 850, like a credit score. A high DivScore® indicates that your 401(k) plan offers good options for diversification, while a low DivScore means the 401(k) plan may need some changes.

Taking Action

Under ERISA provisions, plan sponsors must make sure the fees and costs of their plans are reasonable, and they also have the responsibility of making sure the investment options are adequate and satisfactory for all types of investors. ERISA looks for administrators to be actively monitoring quality and performance of the 401(k), providing responsive services, and to actively "benchmark" fees against other plans.

For investors and administrators alike, it is important to know if all of the expectations of the 401(k) plan are being met. Investors can raise their voice and band together in lawsuits if fees are too high and plans are inadequate, and administrators can make sure they're doing everything they can to prevent complaints and lawsuits from arising.

Tickeron's 401(k) analysis can help investors and administrators know if their 401(k) plan is good enough.

If the analysis indicates that the plan is in need of fixing, investors may consider talking to their HR department or manager about making some improvements; 401(k) trustees may use the findings as motivation to research new options, or shop their plan to new partners.

For investors and administrators alike, it is important to know if all of the expectations of the 401(k) plan are being met. Investors can raise their voice and band together in lawsuits if fees are too high and plans are inadequate, and administrators can make sure they're doing everything they can to prevent complaints and lawsuits from arising.

Tickeron's 401(k) analysis can help investors and administrators know if their 401(k) plan is good enough.

If the analysis indicates that the plan is in need of fixing, investors may consider talking to their HR department or manager about making some improvements; 401(k) trustees may use the findings as motivation to research new options, or shop their plan to new partners.

FAQ: we answer your questions posted here

11

Chapter 3. Diversification Theory: Why It Matters

Diversification is fundamentally important to successful portfolio management. Mixing different kinds of investments with variable time frames and volatility levels allows managers to achieve risk-controlled returns over time. It is important to note that diversification doesn't guarantee improved performance or insulation from risk – rather, it provides the opportunity to earn better returns within pre-decided parameters.

Key to this process is choosing different types of investments with different historical behavior over a given time period—in other words, choosing uncorrelated assets to build a portfolio.

Doing so means that a downturn for one kind of investment does not necessarily mean a wholesale downturn for the rest of a portfolio. It is also vital to diversify within each type of investment – meaning investing across differing market caps or sectors for stocks, variable maturities and durations for bonds, and so on. Choosing investments based on multiple factors minimizes opportunities for a portfolio to behave uniformly, and creates the best for attractive risk-adjusted returns over time.

Key to this process is choosing different types of investments with different historical behavior over a given time period—in other words, choosing uncorrelated assets to build a portfolio.

Doing so means that a downturn for one kind of investment does not necessarily mean a wholesale downturn for the rest of a portfolio. It is also vital to diversify within each type of investment – meaning investing across differing market caps or sectors for stocks, variable maturities and durations for bonds, and so on. Choosing investments based on multiple factors minimizes opportunities for a portfolio to behave uniformly, and creates the best for attractive risk-adjusted returns over time.

Diversification Works

Investors value diversification not because it provides immunity to loss or guarantees desired results, but because it can maximize returns while controlling for risk within an existing investment strategy. Diversifying a portfolio – whether by investment types, concentration of each type, sectors, market cap (for stocks), duration (for bonds), or other factors – means creating balance based on historical behavior that smooths-out rough patches to the greatest possible degree.

To see how this works in an example, take a look at the pie charts below created by Fidelity Investments. As you can see, there are various ways to diversify a portfolio based on your needs and risk tolerance. Conservative investors may choose to limit equity exposure while Aggressive investors may want a lot of it. The risk-reward outcomes for each choice is evident in the chart: aggressive investors endure the possibility of bigger one year gains and bigger one year declines, while more conservative approaches have mitigated impact on the downside but are also likely to deliver lower long-term (20-year annualized) returns. It's a trade-off investors must make depending on what they need out of their investment portfolio.

To see how this works in an example, take a look at the pie charts below created by Fidelity Investments. As you can see, there are various ways to diversify a portfolio based on your needs and risk tolerance. Conservative investors may choose to limit equity exposure while Aggressive investors may want a lot of it. The risk-reward outcomes for each choice is evident in the chart: aggressive investors endure the possibility of bigger one year gains and bigger one year declines, while more conservative approaches have mitigated impact on the downside but are also likely to deliver lower long-term (20-year annualized) returns. It's a trade-off investors must make depending on what they need out of their investment portfolio.

12

Investors would be wise to consider the amount of risk they are comfortable taking before they begin investing. Doing so allows for the creation of a diversified portfolio encompassing various industries, asset types, and other factors that maximizes expected return while minimizing risk relative to the pre-designed level. It will also help you determine where on the scale (as detailed above) you end up.

Diversification is a Long-Term Process—Not a One-Time Action

Once investors consider their long-term objectives and risk tolerance and build an appropriately diversified portfolio to meet their needs, the process does not stop there. Whether alone or with the assistance of an investment professional, successful investing requires vigilance throughout the entire lifespan of an investment. It is important to periodically review portfolios to gauge relative performance, reevaluate risk, and determine changes in strategy, and then of course to rebalance/reallocate the portfolio accordingly as market conditions change. Finally, investors should review their portfolios yearly (or in accordance with special circumstances) to ensure their portfolio reflects their current financial goals.

While it can be tempting to set initial parameters and never revisit them, it's important to consistently review your portfolio for the above reasons.

But another major reason to revisit your portfolio is that performance of different assets can change an allocation over time – sometimes without an investor even realizing it. Stocks, for instance, are prone to larger price swings than bonds and other types of investment, but they also tend to appreciate more over time. As a result, stock-heavy portfolios tend to be more volatile but also may become more stock-heavy with time, i.e., as the percentage of stocks in the portfolio grows relative to the other asset classes.

As you can see in the chart below, semi-annual resetting allowed the portfolio manager on the right to maintain balance in their investment approach, keeping risk at an acceptable level in accordance with their long-term goals. The "buy-and-hold" approach, on the other hand, saw the percentage of stocks in the portfolio grow with time, which may imply that the investor is holding a riskier portfolio than they originally intended.

While it can be tempting to set initial parameters and never revisit them, it's important to consistently review your portfolio for the above reasons.

But another major reason to revisit your portfolio is that performance of different assets can change an allocation over time – sometimes without an investor even realizing it. Stocks, for instance, are prone to larger price swings than bonds and other types of investment, but they also tend to appreciate more over time. As a result, stock-heavy portfolios tend to be more volatile but also may become more stock-heavy with time, i.e., as the percentage of stocks in the portfolio grows relative to the other asset classes.

As you can see in the chart below, semi-annual resetting allowed the portfolio manager on the right to maintain balance in their investment approach, keeping risk at an acceptable level in accordance with their long-term goals. The "buy-and-hold" approach, on the other hand, saw the percentage of stocks in the portfolio grow with time, which may imply that the investor is holding a riskier portfolio than they originally intended.

By defining a set of goals (accounting for parameters like time frame and risk level), investing in a way conducive to that risk level, and managing that plan by rebalancing and refreshing when appropriate, portfolio managers can use diversification to manage risk and reach their goals.

Get Help Diversifying Your Portfolio with Tickeron

Tickeron has created Artificial Intelligence technology that removes the guesswork from portfolio analysis. Not only can Tickeron A.I. analyze your investment portfolio and determine a Diversification Score in seconds – which provides you crucial feedback for evaluating improvements or validating your existing approach – the A.I. can also recommend ways to better diversify your portfolio.

Find out how you can use this technology in your own portfolio today, on tickeron.com.

Find out how you can use this technology in your own portfolio today, on tickeron.com.

The true breakout in December was validated by its ability to break the 50-60 resistance zone.

FAQ: we answer your questions posted here

14

Chapter 4. How to Use Your 401(k) for Financial Success

401(k) plans offer concrete advantages, but they are not a guaranteed path to financial success. Used wisely, however, a 401(k) can accrue real value – and even make you a millionaire.

Save Early, Save Often – And Take Advantage of Employer Contributions

Investors should consider saving into a 401(k) from the very first paycheck onward. While your initial income probably won't allow you to max out early contributions, you can still take advantage of the power of compound interest to multiply the early returns by earning interest on the interest already gained.

The example below illustrates the multiplying effect of compound interest: in it, two accounts receive a $10,000 deposit. The first account has an interest rate of 5 percent per year; the second has the same interest rate, but receives compound interest.

The example below illustrates the multiplying effect of compound interest: in it, two accounts receive a $10,000 deposit. The first account has an interest rate of 5 percent per year; the second has the same interest rate, but receives compound interest.

As interest is added to the total amount saved, that new total figure (including interest) accumulates additional interest the next year. The resulting snowball effect means increasing interest over time. Contributing earlier to a 401(k) allows investors to enjoy these benefits as long as possible.

The multiplying effect offered by compound interest is useful on its own, but can be even more formidable in conjunction with another 401(k) plan feature – matching employer contributions. Matching contributions are, in effect, free money for employees who choose to participate. While the nature of these contributions varies widely, employers typically match up to a certain percentage of an employee's salary. If your employer matches up to a certain percentage of contributions, be sure to contribute at least that much to your 401(k) plan!

The multiplying effect offered by compound interest is useful on its own, but can be even more formidable in conjunction with another 401(k) plan feature – matching employer contributions. Matching contributions are, in effect, free money for employees who choose to participate. While the nature of these contributions varies widely, employers typically match up to a certain percentage of an employee's salary. If your employer matches up to a certain percentage of contributions, be sure to contribute at least that much to your 401(k) plan!

16

Save More as You Earn More

While stagnant wages have made it more difficult for workers to anticipate substantial increases in income, any pay raise can provide the opportunity to take home and save more money. With every compensation increase, investors should avoid a common trap – spending significantly more as you make more.

Rising pay could mean the possibility of hitting the yearly maximum allowable pre-tax contribution – as of 2019, $19,000 – and reap the benefits of the resulting compound earnings. Financial realities may not allow everyone to max out the yearly allowance, but doing so sooner rather than later, if feasible, is advantageous in order to augment contributions to the fullest extent possible.

Rising pay could mean the possibility of hitting the yearly maximum allowable pre-tax contribution – as of 2019, $19,000 – and reap the benefits of the resulting compound earnings. Financial realities may not allow everyone to max out the yearly allowance, but doing so sooner rather than later, if feasible, is advantageous in order to augment contributions to the fullest extent possible.

Keep it Simple and Try to Minimize Fees

Finally, ultra-successful 401(k) contributors tend to develop a solid, simple approach to their plans. Regular re-evaluation of goals, portfolio diversification, and a proactive approach relative to shifting market conditions increases the chances of long-haul success – not chasing a buzzworthy stock or making decisions on whims.

Equally important is remaining vigilant in order to minimize fees. High fees on 401(k) accounts lessen returns, especially when totaled over time – US Department of Labor statistics indicate that fees of 1.5 percent over the lifetime of a 401(k) account will mean a balance 28 percent smaller upon retirement than if fees were 0.5 percent. 401(k) administrators are required by law to disclose the amount they charge in fees on an account – investors would be wise to consider these, then shop their plan if necessary to find the best option for their needs.

Equally important is remaining vigilant in order to minimize fees. High fees on 401(k) accounts lessen returns, especially when totaled over time – US Department of Labor statistics indicate that fees of 1.5 percent over the lifetime of a 401(k) account will mean a balance 28 percent smaller upon retirement than if fees were 0.5 percent. 401(k) administrators are required by law to disclose the amount they charge in fees on an account – investors would be wise to consider these, then shop their plan if necessary to find the best option for their needs.

Conclusion

401(k) plans are popular for a reason – with real tax advantages, the opportunity for employer contributions, a lengthier contribution timeline, and more, they can be truly effective retirement plans.

But not all 401(k)s are perfect. Some plans do not have adequate options to allow participants to build a well-diversified portfolio. Other plans have high fees. And in some cases, investors do not have the adequate guidance needed to properly manage their 401(k)s over time. Tickeron understands these 401(k) limitations, and we have developed A.I.-powered technology to help investors address each issue. Learn more and get started today on tickeron.com.

But not all 401(k)s are perfect. Some plans do not have adequate options to allow participants to build a well-diversified portfolio. Other plans have high fees. And in some cases, investors do not have the adequate guidance needed to properly manage their 401(k)s over time. Tickeron understands these 401(k) limitations, and we have developed A.I.-powered technology to help investors address each issue. Learn more and get started today on tickeron.com.

18

About the Author

Dr. Sergey Savastiouk

in Sergey Savastiouk, Ph.D. has a degree in Applied Mathematics from Moscow University and has extensive experience as an entrepreneur, investor, manager, and mathematician. His professional expertise is in applied mathematics, mathematical modeling, system and pattern analysis, and software and hardware system integration. He has served as the CEO of several hi-tech start-up companies and nonprofit organizations, which has given him proven capabilities in business strategy for high-tech start-up companies, market assessment, company formation, team building, product development, marketing, and sales. He has published numerous articles in journals and magazines on related fields. As a retail investor, he spent 15 years developing his proprietary trading and quantitative algorithms (now Tickeron's A.I.), which brought him significant returns in trading the stock market. His current work and goal in founding Tickeron is to bring professional, sophisticated stock market analysis capabilities to retail investors via an easy-to-use interface.

19

Limitations

The A.I. identifies patterns by their key geometrical elements, formed by changing stock prices when plotted on a chart. The A.I. does not take into consideration stock fundamentals, expert recommendations, market conditions, and so forth. Trading in stocks and other securities involves the risk of loss.

Disclaimers

Although our services incorporate historical financial information, past financial performance is not a guarantee or indicator of future results. Moreover, although we believe the historical information and strategies we use are reliable, we cannot guarantee them. Our services are frameworks to be used in your own investment decisions, but they are not a substitute for your own informed judgment or decisions. Moreover, they provide only some of the resources that could possibly assist you in making your decisions. You may accept, reject or modify the recommendations we provide, and you may consult with other advisors or professionals (at your expense) as you see fit regarding your personal circumstances. We do not and cannot guarantee the future performance of your investments. We do not promise that investments we recommend will be profitable. All investments are subject to various market, currency, economic, political and business risks. We do not guarantee the suitability or value of any investment information or strategy. We do not recommend any brokers or dealers for executing transactions or maintaining accounts and do not provide a mechanism for placing trades through this site. We are not responsible for advice or information you receive from anyone through the use of this site. We are not responsible for any transfers of money to any member outside of our payment system. Additional information can be found in our Terms of Use, Client Agreement, and Privacy Policy.

All graphs and data on our website and marketing materials are based on simulated or hypothetical performance that have certain inherent limitations. Unlike the graphs shown in an actual performance record, these graphs do not represent actual trading. Any trades on websites are recorded paper trades and have not been executed. Simulated or hypothetical trading algorithms in general are also subject to the fact that they might be designed with the benefit of some hindsight during backtesting. No representations are made that any actual account will or is likely to achieve any profits or losses similar to these graphs or data being shown.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading can completely account for the impact of financial risk in actual trading. The ability to withstand losses are material points which can adversely affect actual trading results. There are factors related to the markets in general or to the implementation of any specific trading algorithms, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

TRADING IS RISKY. Past performance is not necessarily indicative of future results. Actively trading in the market may result in the losses of entire principal amount.

All graphs and data on our website and marketing materials are based on simulated or hypothetical performance that have certain inherent limitations. Unlike the graphs shown in an actual performance record, these graphs do not represent actual trading. Any trades on websites are recorded paper trades and have not been executed. Simulated or hypothetical trading algorithms in general are also subject to the fact that they might be designed with the benefit of some hindsight during backtesting. No representations are made that any actual account will or is likely to achieve any profits or losses similar to these graphs or data being shown.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading can completely account for the impact of financial risk in actual trading. The ability to withstand losses are material points which can adversely affect actual trading results. There are factors related to the markets in general or to the implementation of any specific trading algorithms, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

TRADING IS RISKY. Past performance is not necessarily indicative of future results. Actively trading in the market may result in the losses of entire principal amount.

ASSUMPTIONS AND METHODS USED

The following are material assumptions used when calculating any hypothetical graphs and presenting results that appear on our web site:

--Profits are reinvested. We assume profits (when there are profits) are reinvested in the trading algorithms.

--Any trading fees and commissions are not included.

--Profits are reinvested. We assume profits (when there are profits) are reinvested in the trading algorithms.

--Any trading fees and commissions are not included.

FAQ: we answer your questions posted here

20