- Viewing all trend predictions for supported tickers

- Configuring trend alerts

- Viewing bookmarked trend prediction progress

AI Trend Prediction Engine - Stock Analysis

Trading trends is one of the most profitable strategies when you bet on the continuation of an existing trend up or down. If you plan to trade trends then you need Tickeron’s Artificial Intelligence (A.I.) Trend Prediction Engine (TPE). Using TPE, you will instantly get AI’s opinion on whether the stock is going up or down for the next week or month.

How it works

The best way to make money with trend trading is to use our premium tool, Trend Prediction Engine (TPE). You will get signals when to buy and when to sell based on end of day price information. TPE analyses trends for stocks, penny stocks, ETFs, mutual funds, cryptocurrencies and Forex. To make this tool more convenient you have to customize it. Settings include confidence level, price range, asset classes, etc. You also need to set up notifications for emails or push notifications. The more filters you use the fewer trade ideas TPE generates.

Trading trends is one of the most profitable strategies when you bet on the continuation of an existing trend up or down. If you plan to trade trends then you need Tickeron’s Artificial Intelligence (A.I.) Trend Prediction Engine (TPE). Using TPE, you will instantly get AI’s opinion on whether the stock is going up or down for the next week or month.

Our algorithm looks at past changes in price and generates unique insights of future fluctuations. Users can subscribe to ‘A.I. Trend Prediction Engine’ depending on their preferences. Our system provides supporting information like historical statistics and "Trend Prediction Confidence Levels". They measure the level of conviction behind a pattern. Our system also allows the user to view price evolution and bookmark their favorites. The user can act on their trading platform to predict price movements.

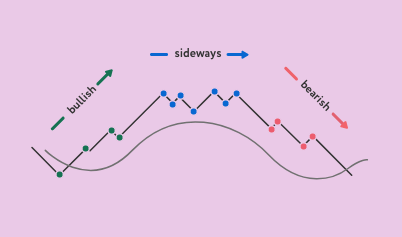

"Trend trading" is an investment strategy based on the technical analysis of changing market prices. Investors who use a trend-tracking strategy attempt to capitalize on shifting market trends. The trend-trader observes the current direction of a stock or an index and use this to make buy or sell decisions. The trend-trader enters into a long position when a stock is trending upward. He or she uses the short position when a stock is trending downward. Traders who use this strategy rarely aim to forecast a specific price target. Instead, they ‘ride’ the trend until the pattern shifts or they’ve made a profit.

If you do not feel comfortable to make your own customizations and settings then you can try our AI Robots which already have minimal number of trades per day and customization work. The good news is that if you buy one or more AI Robots then you will get credit of $60/month or $120/month which you can apply towards subscribing to TPE, i.e. you get TPE for free. If you have any questions you can always call our customer support, view webcasts and videos, or sign up for a 1-on-1 lessons.

Disclaimer

Simulated results (annualized returns, % wins/loss, and other statistics) are achieved by the retroactive application of a backtested model itself designed with the benefit of hindsight. The backtesting of performance differs from the actual account performance because the investment strategy may be adjusted at any time, for any reason and can continue to be changed until desired or better performance results are achieved. Alternative modeling techniques or assumptions might produce significantly different results and prove to be more appropriate. Past hypothetical backtest results are neither an indicator nor a guarantee of future returns. Actual results will vary from the analysis. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. Disclaimers and Limitations