Exela Technologies (XELA) Buy/Sell Alert Setup

How to setup Buy/Sell Daily Alerts

Leveraging Tickeron's AI Alert System offers immediate and insightful buy and sell suggestions, enhancing your investment strategy. Here's how to seamlessly integrate this tool into your trading routine:

Price Reaches Target

Begin by establishing target prices for your stocks. You'll receive prompt notifications whenever the stock's price surpasses or falls below these set benchmarks, allowing for timely decision-making.

Example: The signal is established at $90, and upon the ticker price surpassing the target price of $90, you will be notified.

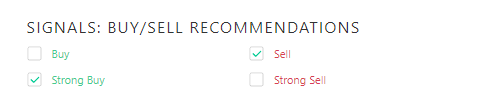

Buy/Sell Recommendations

Choose the types of signals you wish to be notified about. These signals can range from buy, sell, to more definitive indicators such as strong buy and strong sell, providing clarity on market movements.

Example: In this instance, two indicators have been designated as “Strong Buy” and “Sell.” Should the ticker display either signal, a notification will be sent to you.

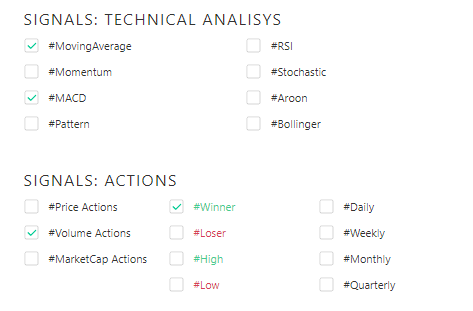

Technical Analysis And Actions

Enhance your trading strategy by selecting signals based on your preferred technical indicators. This customization allows for more tailored and potentially lucrative trading opportunities.

Example: In the given example, the criteria for receiving notifications are established as follows: For technical analysis, the criteria include Moving Average and MACD (Moving Average Convergence Divergence). Regarding actions, the criteria are Volume Actions and Winners. Consequently, I will receive four distinct types of notifications whenever there are news and signals corresponding to these criteria.

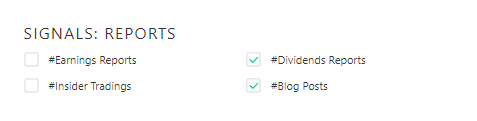

REPORTS

Configure alerts based on specific actions (e.g., win, lose) and market conditions (e.g., high, low)

Example: In the section labeled "Reports" within the example, "Dividends Reports" and "Blog Posts" are specified. Should there be any news regarding dividends associated with the ticker, or in the event the author publishes a new blog, you will be alerted with a notification.

General Information

a provider of financial technology and business services

Industry PackagedSoftware