Horizon Aircraft, trading under the ticker HOVR on NASDAQ, is an advanced aerospace engineering company specializing in hybrid electric Vertical Take-Off and Landing (eVTOL) aircraft, notably the Cavorite X7. In June 2025, HOVR captured significant investor attention due to its remarkable stock performance, surging +302.15% over the month with an average daily trading volume of 2 million shares. This article provides a comprehensive analysis of HOVR’s stock performance, key market news as of June 16, 2025, comparisons with correlated stocks and inverse ETFs, and the role of AI-driven tools like those offered by Tickeron in navigating its market movements.

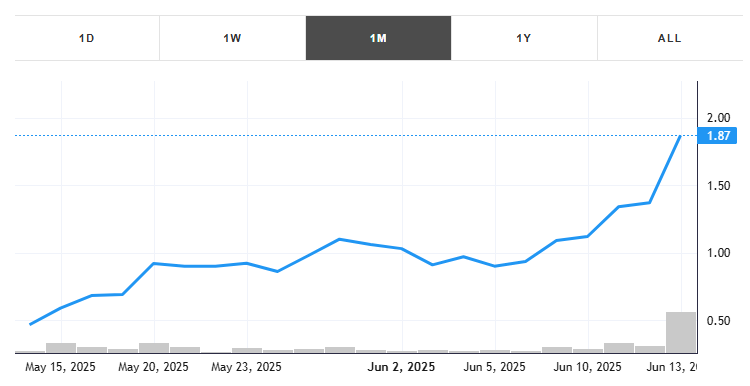

HOVR’s stock experienced an extraordinary rally in June 2025, gaining +302.15% and closing at approximately $1.81 per share on June 13, 2025, with a peak volume of 17.4 million shares on that day. The stock’s market capitalization reached $72.19 million, with a float of 16.25 million shares and a short interest of 1.79%. Social media sentiment on platforms like X highlighted HOVR’s breakout potential, with traders projecting price targets above $2.50 if the upward trend persists. This surge was driven by a low float, high trading volume, and significant news catalysts, positioning HOVR as a top gainer in the aerospace and defense sector.

On June 13, 2025, Horizon Aircraft announced a strategic partnership with MT-Propeller, a global leader in advanced propeller technology, to supply propellers for the Cavorite X7’s hybrid turbine engine. This deal marked Horizon’s first major hardware commitment for full-scale production, signaling progress toward commercializing its innovative eVTOL aircraft. The partnership fueled a +46% stock price surge in the week prior to June 13, with posts on X noting the deal’s potential to drive HOVR toward $2.50+ due to its niche advantage in runway-capable hybrid eVTOL technology.

The broader market in June 2025 was marked by volatility and significant developments. The S&P 500 index faced turbulence following President Trump’s tariff announcements in April, which caused a 19% drop, narrowly avoiding bear market territory. However, a rebound in April and May saw the S&P 500 rise 19.6% over 27 trading days, driven by optimism over softer inflation data and U.S.-China trade negotiation progress. Meanwhile, geopolitical tensions, including Israel’s attacks on Iran’s nuclear program on June 13, shook global markets, boosting oil prices and the S&P 500 Energy Select ETF (XLE) by over 1%. Tech giants like Amazon (AMZN) gained 6.75% over five days, driven by AI investments and trade optimism, while Tesla (TSLA) saw a 30% price jump over the last quarter. These movements underscore a market environment balancing trade optimism, geopolitical risks, and AI-driven growth, all of which contextualize HOVR’s aerospace sector rally.

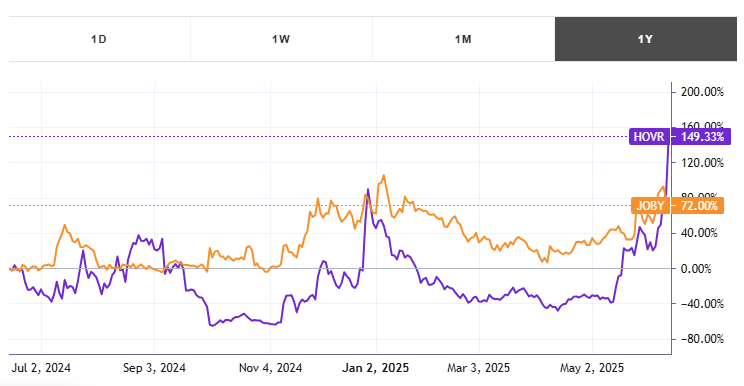

HOVR’s performance can be compared to Joby Aviation (JOBY), another eVTOL company with a high positive correlation to HOVR due to shared market dynamics in the urban air mobility sector. Over the five trading days ending June 10, 2025, JOBY gained approximately 4.5%, underperforming HOVR’s explosive growth but reflecting similar investor enthusiasm for eVTOL innovation. Both companies benefit from the growing demand for sustainable aviation solutions, but HOVR’s lower market cap ($72.19M vs. JOBY’s $1.2B) and recent production milestone give it higher volatility and upside potential. Investors tracking HOVR can use Tickeron’s platform to compare real-time trends and analytics for both stocks.

For traders seeking to hedge HOVR’s volatility, inverse ETFs like the ProShares Short S&P 500 (SH) offer an anti-correlated instrument. SH aims to deliver the daily inverse performance of the S&P 500, which indirectly anti-correlates with HOVR due to its inclusion in broader market indices. During HOVR’s rally in June 2025, SH likely declined by a similar magnitude, reflecting its inverse relationship. Inverse ETFs carry higher risks due to daily rebalancing and are best suited for short-term strategies. Tickeron’s AI tools can help traders identify optimal entry and exit points for SH to mitigate HOVR’s volatility, ensuring precise hedging in high-risk scenarios.

Tickeron, led by CEO Sergey Savastiouk, is transforming financial markets with its Financial Learning Models (FLMs). These models combine technical analysis with machine learning to detect market patterns with precision. Tickeron’s AI Trading Robots and Double Agents, accessible at Tickeron’s bot-trading platform, enable traders to capitalize on HOVR’s bullish and bearish signals simultaneously. For instance, Tickeron’s AI identified a bullish moving average crossover for HOVR on May 15, 2025, signaling potential upside to $2.50. By pairing HOVR with inverse ETFs like SH, Tickeron’s Double Agents offer a hedged approach, reducing risk while amplifying returns. This dual perspective aligns with the growing role of AI in financial decision-making, making Tickeron an essential tool for navigating HOVR’s volatile trajectory.

Analyst sentiment for HOVR remains optimistic, with projections suggesting potential upside to $2.50+ if production milestones are met. However, risks include macroeconomic uncertainties, such as global trade tensions and geopolitical conflicts, which could impact aerospace investments. HOVR’s low float and high volatility also pose challenges for risk-averse investors. Using Tickeron’s AI-driven insights, traders can monitor real-time patterns and macroeconomic factors to make informed decisions. As Horizon Aircraft advances toward Cavorite X7 production, its stock remains a compelling option for investors seeking exposure to the eVTOL sector.