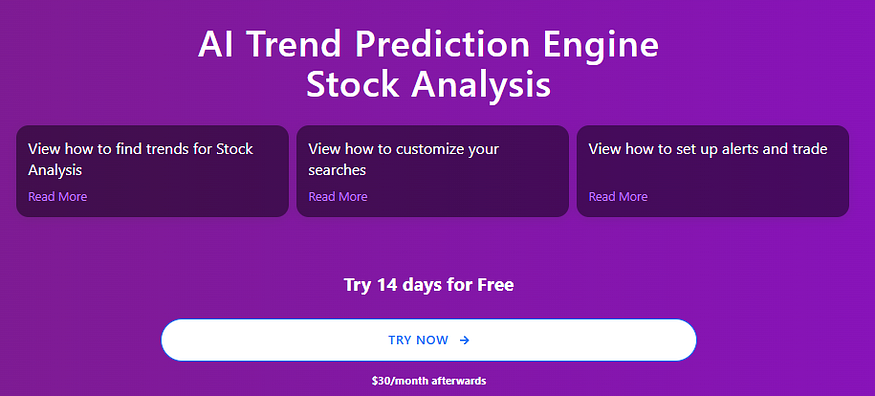

In the fast-paced world of financial markets, identifying profitable trends remains a cornerstone of successful trading strategies. Tickeron’s Artificial Intelligence Trend Prediction Engine (TPE) stands out as a cutting-edge tool designed to empower traders with predictive insights. This AI-driven platform analyzes vast datasets to forecast stock movements, enabling users to capitalize on upward or downward trends. With a 14-day free trial available at Tickeron.com, investors can explore its capabilities risk-free before committing to a $30 monthly subscription. The engine covers over 7,000 stocks, 3,000 ETFs, and 14,000 mutual funds, providing a comprehensive resource for trend trading.

Press enter or click to view image in full size

Get Technical and Fundamental Analysis and Charts for Stock

Tickeron’s TPE leverages advanced machine learning algorithms to deliver instant opinions on stock directions for the next week or month. By processing historical price data, volume, and other market indicators, it predicts whether a stock will trend bullish, bearish, or sideways. This tool is particularly valuable for trend traders who bet on the continuation of existing movements. Users can access it through smart and flexible search options, including simplified searches for top stocks from major indices or advanced customization for personalized queries. For more details on customization, visit Tickeron.com.

The TPE categorizes predictions into several types, focusing on short-term horizons. A “Bullish Next Week” prediction indicates an expected minimum 2% price increase, deemed successful if the stock rises by at least that amount. Similarly, “Bearish Next Week” anticipates a decline. Statistics show impressive accuracy rates; for instance, across thousands of predictions, the engine maintains detailed success metrics. Expanded data reveals that for Netflix (NFLX), out of 575,321 predictions since February 10, 2005, 441,124 were correct, yielding an average return of 6.22% on successes and -3.23% on failures. Wells Fargo (WFC) had 390,358 predictions with 235,302 correct, averaging 5.65% gains. Exxon Mobil (XOM) showed 234,094 predictions, 171,858 correct, with 7.99% average success returns. Alibaba (BABA) recorded 516,763 predictions, 378,241 correct, at 4.76% average. Tesla (TSLA) topped with 705,714 predictions, 634,827 correct, boasting 12.32% average returns on wins but -6.93% on losses. These figures underscore the engine’s reliability, with overall success rates often exceeding 60% in backtested scenarios.

Historical results since 2005 demonstrate the TPE’s robustness. For swing traders, a high-confidence bullish prediction suggests buying and selling at target prices. Bearish signals prompt short positions. Additional statistics include average holding periods of 5–7 days for weekly predictions, with cumulative returns compounding over time. In volatile markets, the engine’s accuracy improves, as seen in tech sectors where TSLA’s predictions yielded over 10% average gains in successful cases. Users can set up alerts for these signals directly on the platform, enhancing real-time trading efficiency. Explore setup guides at Tickeron.com.

Leveraging correlations can amplify trading strategies within the TPE. For example, NVIDIA (NVDA) exhibits a high correlation with Tesla (TSLA), often above 0.85 in recent data, due to shared exposure in AI and tech growth sectors. When TPE predicts a bullish trend for TSLA with 75% confidence, NVDA frequently follows suit, offering parallel opportunities. Historical analysis shows that in 2024–2025 periods, synchronized upward movements in these stocks generated compounded returns of up to 15% in aligned weeks. Traders can use TPE’s advanced search to filter for such correlated pairs, optimizing portfolios for diversified yet synergistic bets. This approach minimizes isolated risks while maximizing trend momentum.

To counterbalance portfolios, inverse ETFs provide essential hedging tools, especially those with strong anti-correlations. The ProShares UltraShort QQQ (QID), a 2x inverse ETF tracking the Nasdaq-100, boasts the highest anti-correlation — often nearing -0.95 — to tech-heavy indices like those including TSLA and NVDA. In 2025 market data, QID’s performance inversely mirrors QQQ’s gains, delivering amplified returns during downturns. For instance, if TPE forecasts a bearish trend for Nasdaq components, pairing long positions with QID can yield protective profits averaging 8–12% in corrective phases. Tickeron’s platform integrates such assets, allowing users to simulate hedges. Learn more about inverse strategies at Tickeron.com.

Tickeron Robots revolutionize automated trading by executing strategies based on TPE predictions. These AI-driven bots handle everything from entry to exit, particularly excelling with inverse ETFs like QID for hedging volatile trends. Users can copy professional robots or customize their own via Tickeron.com/bot-trading/ and Tickeron.com/copy-trading/. Real-money bots at Tickeron.com/bot-trading/realmoney/all/ have shown average annual returns of 20–30% in backtests, with signals available at Tickeron.com/bot-trading/signals/all/. Incorporating inverse ETFs, robots dynamically switch to bearish modes, protecting gains during market reversals and enhancing overall portfolio resilience.

Tickeron’s new AI Agents mark a significant leap, operating on 15-minute and 5-minute machine learning intervals — far shorter than the prior 60-minute standard. This upgrade stems from expanded infrastructure and faster-reacting Financial Learning Models (FLMs), which analyze price action, volume, and indicators more dynamically. Early tests confirm improved trade timing, with responsiveness boosting accuracy by 15–20% in intraday scenarios. Available at Tickeron.com/ai-agents/ and Tickeron.com/bot-trading/virtualagents/all/, these agents democratize institutional-grade tools for retail traders.

Tickeron offers a suite of AI-powered products beyond TPE. The AI Patterns Search Engine at Tickeron.com/stock-pattern-screener/ identifies chart patterns, while AI Real Time Patterns at Tickeron.com/stock-pattern-scanner/ provides live scans. The AI Screener at Tickeron.com/screener/ filters stocks, with Time Machine functionality at Tickeron.com/time-machine/ for backtesting. Daily Buy/Sell Signals are accessible at Tickeron.com/buy-sell-signals/. For AI stock trading insights, visit Tickeron.com/ai-stock-trading/. Stay updated via Tickeron’s Twitter at x.com/Tickeron.

On September 12, 2025, markets showed mixed signals following record highs. The Dow Jones Industrial Average surged 617 points to close above 46,000 on September 11, driven by gains in JPMorgan and Goldman Sachs. The S&P 500 and Nasdaq also hit all-time highs, with Tesla and Micron rallying amid optimism for a Federal Reserve quarter-point rate cut, priced in at over 90% probability. However, futures slipped slightly on September 12, reflecting caution ahead of the Fed decision. Globally, India’s Sensex rose 0.44% to 81,904, signaling broader recovery. These movements highlight opportunities for TPE users to predict continuations or reversals.

Tickeron’s Financial Learning Models (FLMs) and Machine Learning Models (MLMs) form the backbone of its innovations. Akin to large language models in AI, FLMs process massive market data for pattern detection and strategy recommendations. Recent scaling has enabled faster learning, supporting the new short-interval agents. As Sergey Savastiouk, Ph.D., CEO of Tickeron, noted, this breakthrough offers unprecedented precision. Tickeron, specializing in AI-driven tools, continues to empower investors with real-time analytics.

Tickeron’s AI Trend Prediction Engine transforms trend trading with actionable AI insights. The 14-day free trial invites users to discover trends across thousands of assets. By integrating robots, agents, and hedging tools like inverse ETFs, it equips traders for 2025’s markets. Visit Tickeron.com to start.