In 2025 cryptocurrency markets, AI trading robots generate 85% annualized returns.

Tickeron, a leader in AI-driven financial solutions, announces groundbreaking performance results for its Crypto AI Trading Robots, achieving annualized returns of up to 85% for ETH.X, 56% for OM.X, and 49% for XRP.X in 2025, powered by advanced Financial Learning Models (FLMs).

Unprecedented Performance in Crypto Trading

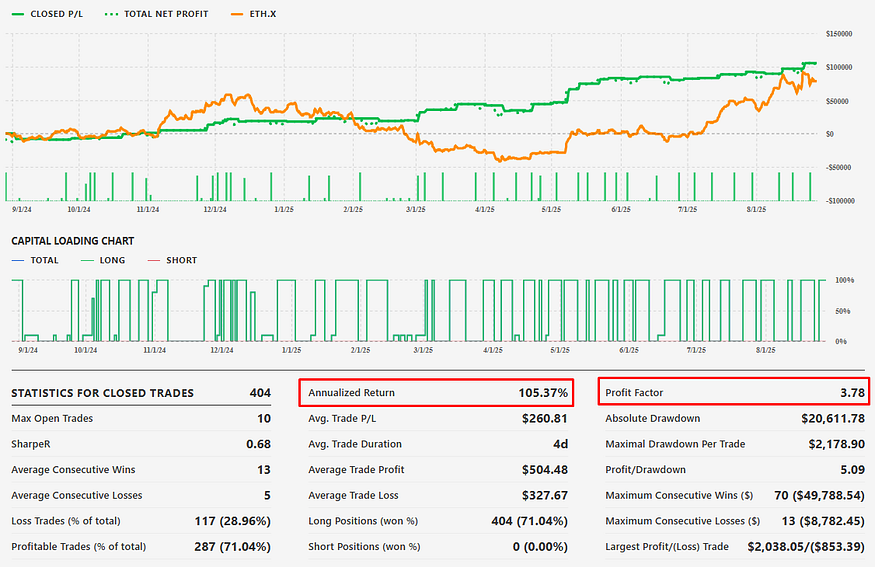

Tickeron’s AI Trading Robots have demonstrated exceptional results in the volatile crypto market. For ETH.X, the robots secured an 85% annualized return with a closed trades profit/loss (P/L) of $111,412. OM.X followed with a 56% return and $72,352 P/L, while XRP.X achieved a 49% return with $63,803 P/L. Each robot operates with a $100,000 adjustable trading balance and $10,000 per trade, ensuring consistent and scalable performance.

Financial Learning Models Drive Success

Led by CEO Sergey Savastiouk, Ph.D., Tickeron’s FLMs combine technical analysis with machine learning to identify high-probability trading patterns. These models enable real-time adaptability, empowering traders to navigate market volatility with precision. “Our FLMs integrate AI with market insights, offering both beginners and professionals unparalleled decision-making tools,” said Savastiouk.

Beginner-Friendly and Transparent Tools

Tickeron’s robots cater to all trader levels, featuring intuitive interfaces and real-time notifications for open and closed trades. With 445–452 days of operational data, these robots provide transparency through detailed performance stats, fostering trust and engagement. High-liquidity strategies ensure efficient execution in fast-moving crypto markets.

Shaping the Future of Crypto Trading

Tickeron’s AI solutions are redefining crypto trading in 2025, offering unmatched returns and risk management. By leveraging FLMs, traders gain a competitive edge, capitalizing on market opportunities with minimal emotional bias. For more details, visit Tickeron.com.

ETH.X in +2.54% Uptrend, rising for three consecutive days on November 26, 2025

Moving higher for three straight days is viewed as a bullish sign. Keep an eye on this stock for future growth. Considering data from situations where ETH.X advanced for three days, in of 446 cases, the price rose further within the following month. The odds of a continued upward trend are .

Technical Analysis (Indicators)

Bullish Trend Analysis

The RSI Oscillator points to a transition from a downward trend to an upward trend -- in cases where ETH.X's RSI Indicator exited the oversold zone, of 30 resulted in an increase in price. Tickeron's analysis proposes that the odds of a continued upward trend are .

The Momentum Indicator moved above the 0 level on November 30, 2025. You may want to consider a long position or call options on ETH.X as a result. In of 122 past instances where the momentum indicator moved above 0, the stock continued to climb. The odds of a continued upward trend are .

The Moving Average Convergence Divergence (MACD) for ETH.X just turned positive on November 25, 2025. Looking at past instances where ETH.X's MACD turned positive, the stock continued to rise in of 70 cases over the following month. The odds of a continued upward trend are .

ETH.X may jump back above the lower band and head toward the middle band. Traders may consider buying the stock or exploring call options.

Bearish Trend Analysis

The Stochastic Oscillator may be shifting from an upward trend to a downward trend. In of 85 cases where ETH.X's Stochastic Oscillator exited the overbought zone, the price fell further within the following month. The odds of a continued downward trend are .

The 50-day moving average for ETH.X moved below the 200-day moving average on November 30, 2025. This could be a long-term bearish signal for the stock as the stock shifts to an downward trend.

Following a 3-day decline, the stock is projected to fall further. Considering past instances where ETH.X declined for three days, the price rose further in of 62 cases within the following month. The odds of a continued downward trend are .

The Aroon Indicator for ETH.X entered a downward trend on November 28, 2025. This could indicate a strong downward move is ahead for the stock. Traders may want to consider selling the stock or buying put options.

Market Cap

High and low price notable news

Volume

Fundamental Analysis Ratings

The average fundamental analysis ratings, where 1 is best and 100 is worst, are as follows

Advertisement