The stock market, with its intricate patterns and rapid fluctuations, has long been a challenging arena for investors. However, advancements in artificial intelligence (AI) have transformed how traders approach the market, offering tools that simplify decision-making and enhance profitability. Tickeron, a leader in AI-powered trading solutions, has pioneered a suite of innovative tools designed to make high-quality analytics accessible to all investors. By leveraging Financial Learning Models (FLMs) and sophisticated algorithms, Tickeron provides daily buy/sell signals, AI-driven trading agents, and real-time market insights to empower traders to navigate the stock market with confidence. This article explores Tickeron’s offerings, focusing on its Daily Buy/Sell Signals, AI Trading Agents, and the use of inverse ETFs in automated trading strategies, providing a comprehensive guide for investors seeking to maximize their trading success.

The Evolution of AI in Stock Market Trading

The integration of AI into financial markets has revolutionized trading, enabling faster and more accurate analysis of vast datasets. Traditional stock analysis often relied on fundamental factors like revenue, management quality, or debt levels, which provided a limited view of market dynamics. Technical analysis, involving chart patterns and indicators, offered additional insights but required significant time and expertise. Tickeron bridges this gap by combining fundamental and technical analysis through its proprietary Financial Learning Models (FLMs), which process price action, volume, news sentiment, and macroeconomic indicators to generate actionable trading signals. These models, akin to Large Language Models (LLMs) in natural language processing, continuously learn from market data, adapting to changing conditions and identifying profitable opportunities with high precision.

Tickeron’s mission is to democratize access to institutional-grade analytics, making sophisticated tools affordable and user-friendly for retail investors. By processing enormous volumes of data in milliseconds, Tickeron’s AI delivers insights that would take human analysts hours or days to compile. This efficiency is particularly evident in its Daily Buy/Sell Signals, which provide clear, actionable recommendations to help traders make informed decisions without the burden of manual research. As Dr. Sergey Savastiouk, CEO of Tickeron, notes, “Participating in trading shouldn’t be a financial burden. Our AI can perform an immense amount of analysis in milliseconds, and such power should be accessible to a broad population to help them understand how signal-based trading works.”

Understanding Tickeron’s Daily Buy/Sell Signals

How Daily Buy/Sell Signals Work

Tickeron’s Daily Buy/Sell Signals are a cornerstone of its platform, designed to simplify the trading process for both novice and experienced investors. These signals are generated using a multifaceted analytical system that integrates a Technical Analysis (TA) Score, a Fundamental Analysis (FA) Score, and a proprietary Buy/Sell Rating System. The TA Score leverages indicators such as Moving Averages, Relative Strength Index (RSI), Stochastic, and MACD, processed through neural networks to identify overbought or oversold conditions, trend reversals, and other market patterns. The FA Score evaluates a company’s financial health, including revenue growth, debt levels, and earnings, to provide a holistic view of investment potential. These scores are combined to produce one of three recommendations: Buy, Sell, or Hold, which are delivered daily after the trading session ends.

The signals are calculated overnight, processing end-of-day (EOD) prices to generate recommendations that reflect the latest market conditions. When a signal changes for a specific ticker, users receive immediate notifications via email or the “My Notifications” page on Tickeron’s website, ensuring they can act promptly. The simplicity of the system is a key strength: trades are initiated at 9:40 ET, ten minutes after the market opens, with a fixed stop loss and a 3% take-profit level set from the current stock price. The average trade duration is approximately two days, allowing for efficient capital use without tying up funds for extended periods.

Setting Up Signals on Tickeron

Setting up buy/sell signals on Tickeron’s platform is intuitive and user-friendly. Investors can configure alerts from various sections of the website, such as their Home Watchlist or the AI Screener. To set up signals from a watchlist, users click the bell icon on the watchlist page, select the desired signal type (Buy, Sell, or Hold), and click “Save & Start.” Alternatively, signals can be configured directly from a ticker’s card by clicking the ticker name and selecting “Set up signals.” This streamlined process ensures that even beginners can quickly establish alerts tailored to their trading preferences.

Once set up, notifications are delivered promptly to the user’s email or the “Ticker Alerts” section of the “My Notifications” page. This real-time delivery allows traders to stay informed without constantly monitoring the market. The ability to customize alerts for specific stocks, ETFs, or other assets ensures that users receive only the most relevant updates, enhancing their ability to react swiftly to market changes.

Tickeron’s AI-Powered Product Suite

AI Trend Prediction Engine

Tickeron’s AI Trend Prediction Engine is a powerful tool that forecasts market trends by analyzing historical price patterns and current market conditions. Using machine learning algorithms, the engine identifies recurring trends and predicts future price movements with a high degree of accuracy. This tool is particularly valuable for swing traders and long-term investors seeking to capitalize on sustained market trends. By integrating data from multiple sources, including price action and macroeconomic indicators, the Trend Prediction Engine provides a robust foundation for strategic trading decisions.

AI Pattern Search Engine

The AI Pattern Search Engine scans the market for technical patterns, such as head-and-shoulders, triangles, or double bottoms, that signal potential price movements. By leveraging neural networks and deep historical backtests, the engine identifies patterns with high-probability outcomes, enabling traders to anticipate market shifts. This tool is ideal for technical traders who rely on chart patterns to inform their strategies, offering a level of precision that manual analysis cannot match.

AI Real-Time Patterns

For intraday traders, Tickeron’s AI Real-Time Patterns tool provides immediate insights into emerging market patterns. Unlike traditional analysis, which often lags behind market movements, this tool processes data in real time, identifying patterns as they form. This capability is critical for day traders who need to act quickly on short-term opportunities. The Real-Time Patterns tool complements the Daily Buy/Sell Signals by offering a granular view of market dynamics, enabling traders to fine-tune their entry and exit points.

AI Screener and Time Machine

The AI Screener is a versatile tool that filters stocks based on user-defined criteria, such as technical indicators, fundamental metrics, or sector performance. Traders can save watchlists created with the AI Screener and set up signals to monitor specific stocks or ETFs. The “Time Machine” feature within the AI Screener allows users to backtest their strategies against historical data, simulating how a portfolio would have performed under past market conditions. This feature empowers traders to refine their strategies and optimize their performance before committing real capital.

Daily Buy/Sell Signals

As discussed, the Daily Buy/Sell Signals are a flagship offering, combining technical and fundamental analysis to deliver clear recommendations. The signals are backed by Tickeron’s proprietary “Odds of Trading Success” formula, which uses AI-driven backtesting to assess the likelihood of a trade’s success based on historical outcomes. This metric enhances trader confidence by providing a data-driven estimate of potential profitability.

The Power of Tickeron’s AI Trading Agents

Revolutionizing Trading with AI Agents

Tickeron’s AI Trading Agents represent a significant leap forward in automated trading, offering strategies optimized for various market conditions and asset classes. These agents, powered by Financial Learning Models (FLMs), have been enhanced with the introduction of 15-minute and 5-minute machine learning time frames, a departure from the industry-standard 60-minute intervals. This advancement allows the agents to process market data more frequently, resulting in faster and more precise entry and exit signals. Early backtests and forward testing have shown that these shorter time frames improve responsiveness to rapid market movements, providing a competitive edge for both retail and institutional traders.

The AI Trading Agents operate across multiple strategies, including single, double, multi, and hedge approaches, with a particular emphasis on inverse ETFs. For example, agents trading inverse ETFs like $SOXS and $QID have achieved impressive annualized returns, with some reaching up to +455% on specific pairs like $ON/$SOXS. These agents analyze vast datasets, including price action, volume, and sentiment, to identify optimal trading opportunities. By automating trade execution and incorporating dynamic risk management, the agents minimize human error and emotional bias, enabling traders to focus on strategy rather than execution.

Trading with Inverse ETFs

Inverse ETFs, which gain value when the underlying index or sector declines, are a powerful tool for traders seeking to profit from market downturns or hedge their portfolios. Tickeron’s AI Trading Agents are particularly adept at navigating the complexities of inverse ETFs, such as $SOXS (Direxion Daily Semiconductor Bear 3X Shares) and $QID (ProShares UltraShort QQQ). These ETFs are designed to deliver inverse performance to their respective benchmarks, often with leverage, making them high-risk, high-reward instruments. Tickeron’s FLMs analyze market trends and volatility to time trades in inverse ETFs, capitalizing on short-term declines in sectors like semiconductors or technology.

For instance, a trader using Tickeron’s AI Agent to trade $SOXS could benefit from the agent’s ability to detect bearish patterns in semiconductor stocks, executing buy orders when the sector is overbought and selling when the trend reverses. The 15-minute and 5-minute ML time frames enhance this strategy by allowing the agent to react to intraday price swings, which are particularly pronounced in leveraged ETFs. This precision has led to win rates exceeding 85% in some cases, as reported in Tickeron’s updates on July 8, 2025. By integrating inverse ETFs into its strategies, Tickeron enables traders to diversify their approaches and mitigate risk in volatile markets.

Enhancing Trading Strategies with FLMs and MLMs

The Role of Financial Learning Models

Tickeron’s Financial Learning Models (FLMs) are at the heart of its AI-driven ecosystem, functioning similarly to Large Language Models but tailored for financial markets. FLMs continuously process vast datasets, including historical and real-time price data, trading volume, news sentiment, and macroeconomic indicators. By applying machine learning techniques, FLMs detect patterns and correlations that human analysts might overlook, generating predictive models that adapt to evolving market conditions. This adaptability is crucial in volatile environments, where traditional models often fail to keep pace.

The recent upgrade to 15-minute and 5-minute ML time frames has significantly enhanced the FLMs’ performance. By analyzing data at shorter intervals, the models capture intraday trends and micro-patterns, enabling faster and more accurate trade recommendations. This improvement is particularly valuable for day traders and those using leveraged instruments like inverse ETFs, where timing is critical. The FLMs’ ability to learn from new data ensures that Tickeron’s AI remains relevant and effective, even in rapidly changing markets.

Machine Learning Models in Action

Tickeron’s Machine Learning Models (MLMs) complement the FLMs by focusing on specific trading strategies and asset classes. For example, MLMs optimized for small-cap stocks or cryptocurrencies analyze niche datasets to identify high-probability trades. These models are backtested against historical data to validate their performance, with some achieving annualized returns 50–90% above market benchmarks. The integration of MLMs into Tickeron’s AI Trading Agents allows for customized strategies, such as long/short positions or hedging with inverse ETFs, tailored to individual trader preferences.

The combination of FLMs and MLMs creates a robust framework for automated trading. Traders can select AI Agents that align with their risk tolerance and investment goals, confident that the underlying models are grounded in rigorous data analysis. Tickeron’s commitment to continuous improvement ensures that its MLMs evolve with market trends, maintaining their edge in a competitive landscape.

Practical Applications for Traders

Building a Watchlist

A key feature of Tickeron’s platform is its watchlist functionality, which allows traders to track their favorite stocks, ETFs, or other assets in real time. Users can create personalized watchlists to monitor price movements, technical indicators, and fundamental metrics, receiving customized alerts based on their selected signals. To create a watchlist, traders navigate to the “View a Watchlist” section on Tickeron’s website, select the desired assets, and save their preferences. The platform’s AI Screener can further refine watchlists by filtering stocks based on specific criteria, such as RSI levels or earnings growth, ensuring that traders focus on opportunities that match their strategies.

Executing Trades with Confidence

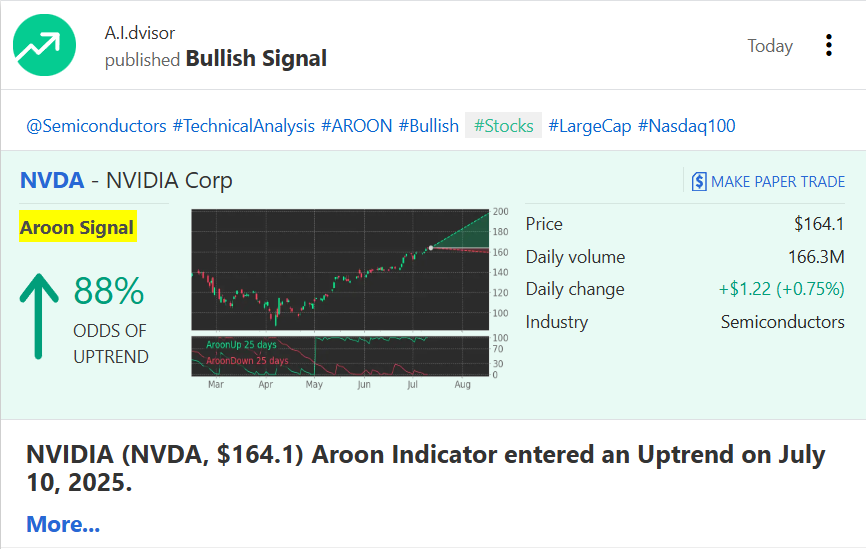

Tickeron’s Daily Buy/Sell Signals and AI Trading Agents simplify trade execution by providing clear, data-driven recommendations. For example, a trader receiving a Buy signal for $NVDA at 9:40 ET can enter a position with predefined stop-loss and take-profit levels, reducing the need for manual analysis. The AI Trading Agents take this a step further by automating trade execution, allowing traders to set parameters and let the system manage positions. This automation is particularly beneficial for inverse ETFs, where rapid price movements require quick decision-making. By relying on Tickeron’s AI, traders can execute trades with confidence, knowing that their decisions are backed by advanced analytics.

Risk Management and Diversification

Effective risk management is critical in stock trading, particularly when using leveraged instruments like inverse ETFs. Tickeron’s AI Trading Agents incorporate dynamic risk management protocols, such as fixed stop-loss orders and take-profit levels, to protect capital. The platform also supports diversification by offering signals and strategies across multiple asset classes, including stocks, ETFs, cryptocurrencies, and forex. By combining long positions in growth stocks with short positions in inverse ETFs, traders can hedge their portfolios against market downturns, balancing risk and reward.

Case Studies: Success Stories with Tickeron

Small-Cap Trading Success

Tickeron’s AI Robot for small-cap stock trading has demonstrated remarkable success, as highlighted in its July 2025 updates. By leveraging machine learning and real-time analysis, the robot identifies undervalued small-cap stocks with high growth potential. For example, Sonnet BioTherapeutics ($SONN) surged 316% in five days, driven by clinical trial success and strategic deals. Tickeron’s AI Trading Agents provided timely buy signals, enabling traders to capitalize on this rally. The platform’s ability to filter small-cap stocks using the AI Screener and backtest strategies with the Time Machine feature ensures that traders can replicate such successes with confidence.

Inverse ETF Performance

Tickeron’s AI Trading Agents have also excelled in trading inverse ETFs, particularly in volatile sectors like technology and semiconductors. A notable example is the +455% annualized return achieved by an AI Double Agent trading $ON/$SOXS. By analyzing intraday patterns and leveraging 5-minute ML time frames, the agent timed entries and exits to maximize profits during sector downturns. This performance underscores the value of Tickeron’s FLMs in navigating high-risk, high-reward instruments, offering traders a powerful tool to profit from market volatility.

Challenges and Considerations

Understanding Market Risks

While Tickeron’s AI tools enhance trading efficiency, it’s essential to acknowledge the inherent risks of financial markets. Trading, particularly with leveraged ETFs, carries significant risk, and profits are not guaranteed. Tickeron emphasizes this in its disclaimers, noting that all trading decisions are at the user’s risk. Traders should combine AI signals with their own research and risk management strategies to mitigate potential losses.

User Feedback and Limitations

Some users have reported mixed experiences with Tickeron’s recommendations, with one X user noting that following signals inversely (buying on Sell signals and vice versa) yielded better results. This feedback highlights the importance of understanding the context of AI signals and testing strategies in a demo account before committing capital. Tickeron’s trading simulators and backtesting tools, such as the Time Machine, allow users to validate signals and refine their approaches, addressing potential limitations.

The Future of AI-Driven Trading with Tickeron

Tickeron’s advancements in AI, particularly the introduction of 15-minute and 5-minute ML time frames, signal a new era in trading technology. By scaling its AI infrastructure and enhancing its FLMs, Tickeron has positioned itself at the forefront of financial innovation. The company’s commitment to accessibility ensures that retail traders can leverage institutional-grade tools without prohibitive costs. Future developments may include further refinements to FLMs, expanded asset class coverage, and integration with emerging technologies like Web3, as hinted in Tickeron’s recent announcements.

For traders seeking to explore Tickeron’s offerings, the platform provides a wealth of resources, including customer webcasts, 1-on-1 lessons, and a comprehensive Help Center. By visiting Tickeron’s virtual agents page, users can explore the full range of AI Trading Agents and their performance metrics. The combination of Daily Buy/Sell Signals, AI-powered tools, and automated trading strategies empowers investors to navigate the stock market with confidence, turning complex data into actionable insights.

Conclusion

Navigating the stock market requires a blend of knowledge, strategy, and timely decision-making. Tickeron’s AI-driven platform, with its Daily Buy/Sell Signals, AI Trading Agents, and Financial Learning Models, offers a transformative approach to trading. By simplifying the process of setting up signals, providing real-time insights, and automating high-precision trades, Tickeron empowers investors to achieve their financial goals. Whether trading inverse ETFs, small-cap stocks, or major indices, users can rely on Tickeron’s advanced analytics to make informed decisions. As the platform continues to innovate, it remains a vital resource for traders seeking to conquer the complexities of the stock market with confidence. Visit Tickeron.com to unlock the power of AI-driven trading today.