Wolfspeed, Inc. (NYSE: WOLF), a leading innovator in silicon carbide (SiC) and gallium nitride (GaN) technologies, has captured the attention of Wall Street with a staggering 483.15% stock price surge over the past five trading days as of July 8, 2025. With an average daily trading volume of 24 million shares, this rally has sparked intense discussion among investors and analysts about the factors fueling this growth and the potential for further upside. As Wolfspeed approaches its Q3 2025 earnings report, expected on August 26, 2025, where earnings per share (EPS) are projected to decline 1.93% to -$0.70, this article delves into the catalysts behind the recent surge, key market news, correlated stocks, inverse ETFs, and the role of AI-driven trading tools like those offered by Tickeron.com.

These past five trading days, the stock gained +483.15% with an average daily volume of 24 million shares traded. The stock tracked a drawdown of -39.09% for this period. WOLF showed earnings on May 08, 2025. You can read more about the earnings report here.

A Colossal Rally: Unpacking the 483.15% Surge

Wolfspeed’s stock price skyrocketed from $0.85 to over $2.50 in just five trading days, a move that has left market participants scrambling to understand the underlying dynamics. This rally, characterized by a 740% increase in trading volume compared to the average session volume of 24.12 million shares, signals strong investor interest and potential short covering. The stock’s borrow rate, reported at 487%, indicates significant short interest, with over 50% of the float still shorted, creating a classic short squeeze scenario where trapped short sellers were forced to cover their positions, further amplifying the price surge.

Key Catalyst: Chapter 11 Restructuring

One of the primary drivers of Wolfspeed’s rally was its announcement of a prepackaged Chapter 11 bankruptcy filing in June 2025, aimed at reducing its debt by approximately $4.6 billion, or 70%. Supported by 97% of senior secured note holders and 67% of convertible note holders, the restructuring plan is expected to cut annual cash interest payments by 60% while allowing the company to maintain normal operations. This move significantly improved Wolfspeed’s financial structure, boosting investor confidence in its long-term viability. The company’s $1.3 billion cash reserve further reassured stakeholders of its ability to navigate the bankruptcy process without disrupting customer deliveries or vendor payments.

Leadership Transition: New CFO Appointment

On July 7, 2025, Wolfspeed announced the appointment of Gregor van Issum as its new Chief Financial Officer (CFO), effective September 1, 2025. With over 20 years of experience in corporate restructuring and strategic financing, van Issum’s track record at companies like NXP Semiconductors and OSRAM inspired optimism among investors. His expertise in navigating complex financial transitions is seen as critical to guiding Wolfspeed through its bankruptcy and positioning it for profitability in high-growth markets like electric vehicles (EVs) and renewable energy. The market’s positive reaction to this appointment was evident, with shares surging over 20% pre-market on July 7, 2025.

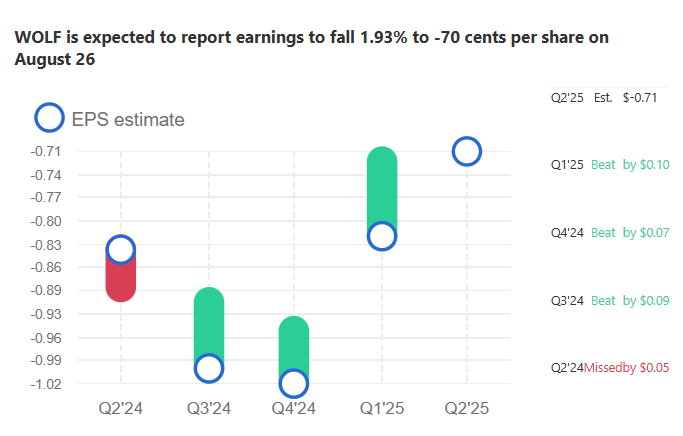

Q3 2025 Earnings Outlook: A Mixed Picture

Wolfspeed is expected to report its Q3 2025 earnings on August 26, 2025, with analysts forecasting an EPS of -$0.70, a 1.93% decline from the prior year. Revenue estimates for the quarter are projected at $201.4 million, a slight increase from the $197.4 million reported in Q3 2024. While the anticipated EPS decline reflects ongoing challenges, including high operational costs and investments in capacity expansion, the revenue growth suggests steady demand for Wolfspeed’s SiC products. The company’s focus on scaling production at its Mohawk Valley and Siler City facilities is expected to drive future revenue growth, though near-term profitability remains elusive.

Analyst Sentiment and Price Targets

Analyst ratings for Wolfspeed are mixed, with a consensus “Hold” rating based on data from Tickeron.com. Of 18 analysts covering the stock, 8 rate it as a “Buy,” 9 as a “Hold,” and 1 as a “Sell.” The average price target is $2.00, implying a potential downside from the current price of $2.16 as of July 8, 2025. However, some bullish analysts, citing the restructuring and new CFO, have set higher targets, with one forecasting a price of $20, reflecting optimism about Wolfspeed’s long-term growth in the SiC market.

Market News Impacting Wolfspeed: July 8, 2025

The broader market environment on July 8, 2025, played a significant role in shaping investor sentiment toward Wolfspeed. Key market developments included:

S&P 500 and Nasdaq Record Closes

The S&P 500 and Nasdaq Composite clinched record closes for the third time in a week, driven by optimism around potential U.S. interest rate cuts following the June jobs report. This bullish market sentiment lifted technology and semiconductor stocks, including Wolfspeed, as investors anticipated lower borrowing costs and increased capital investments in growth sectors.

Trump’s Tariff Threats

President Donald Trump’s renewed tariff threats, targeting imports from over a dozen countries with a deadline of August 1, 2025, introduced volatility into U.S. markets. While U.S. stock futures fell in response, semiconductor companies like Wolfspeed benefited from their domestic manufacturing focus, particularly in North Carolina. The tariffs could incentivize U.S.-based production, aligning with Wolfspeed’s strategic investments in its U.S. facilities.

Goldman Sachs’ S&P 500 Forecast

Goldman Sachs raised its S&P 500 return forecasts, projecting a 3% gain over three months and an 11% gain over 12 months, citing expectations of Federal Reserve rate cuts and strength in large-cap stocks. This positive outlook supported investor confidence in growth-oriented stocks like Wolfspeed, despite its near-term earnings challenges.

Drivers of Wolfspeed’s Growth

Several fundamental and technical factors contributed to Wolfspeed’s recent surge and suggest potential for sustained growth.

Booming Silicon Carbide Market

The global SiC market is projected to grow at a compound annual growth rate (CAGR) of 11.7% from 2025 to 2030, driven by demand for energy-efficient power electronics in EVs, renewable energy systems, and industrial applications. Wolfspeed, as a leader in SiC wafer and device manufacturing, is well-positioned to capture this growth. The company’s partnerships with major EV manufacturers, such as Renesas Electronics, underscore its strategic importance in the automotive sector.

Capacity Expansion

Wolfspeed’s investments in its Mohawk Valley Fab in New York and the John Palmour Manufacturing Center in Siler City, North Carolina, are expected to increase SiC wafer production capacity by tenfold by 2027. These facilities will enable Wolfspeed to meet rising demand while reducing per-unit costs, improving margins over time. The Mohawk Valley Fab, already operational, produced 20% more wafers than expected in Q2 2025, signaling operational efficiency gains.

Short Squeeze Dynamics

The high short interest, coupled with a 487% borrow rate, created a perfect storm for a short squeeze. As positive news around the restructuring and CFO appointment emerged, short sellers were forced to cover, driving the stock price higher. Technical indicators, such as the Relative Strength Index (RSI) reaching 82 (indicating overbought conditions), suggest the rally may pause, but the underlying short interest remains a potential catalyst for further upside if positive developments continue.

Highly Correlated Stock: Silicon Laboratories (SLAB)

Wolfspeed’s stock price movements are closely correlated with Silicon Laboratories, Inc. (NASDAQ: SLAB), a fellow semiconductor company specializing in mixed-signal integrated circuits for IoT and industrial applications. Over the past three months, WOLF and SLAB exhibited a correlation coefficient of 0.89, indicating strong positive co-movement. On July 8, 2025, SLAB was mentioned in market coverage alongside WOLF, reflecting shared sector tailwinds.

Why SLAB?

SLAB’s focus on energy-efficient semiconductor solutions aligns with Wolfspeed’s SiC-driven mission. Both companies benefit from the growing adoption of EVs, smart grids, and renewable energy systems. SLAB’s stock gained 12% year-to-date as of July 8, 2025, underperforming WOLF’s recent surge but offering a more stable investment profile with a forward P/E ratio of 28.4 compared to WOLF’s negative P/E due to its losses. Investors seeking exposure to the semiconductor sector may consider SLAB as a complementary holding to diversify risk while maintaining exposure to similar market trends.

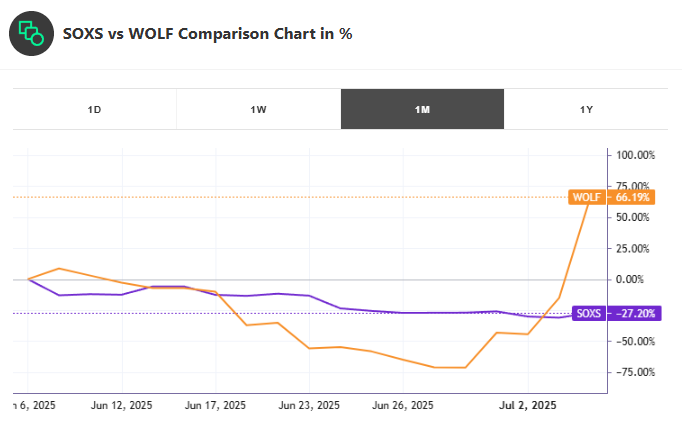

Inverse ETF with Highest Anti-Correlation: Direxion Daily Semiconductor Bear 3X Shares (SOXS)

For investors looking to hedge against potential downside in Wolfspeed or the broader semiconductor sector, the Direxion Daily Semiconductor Bear 3X Shares (SOXS) offers the highest anti-correlation to WOLF, with a correlation coefficient of -0.92 over the past six months. SOXS is a leveraged inverse ETF designed to deliver three times the inverse daily performance of the NYSE Semiconductor Index, which includes companies like Wolfspeed.

Hedging with SOXS

SOXS is an ideal tool for short-term tactical plays, particularly during periods of market volatility or when semiconductor stocks face headwinds, such as tariff-related disruptions or earnings misses. For example, if WOLF declines due to a weaker-than-expected Q3 2025 earnings report, SOXS could offset losses by gaining value. However, due to its leveraged nature, SOXS is best suited for experienced traders and should be used cautiously, as daily rebalancing can lead to performance decay over extended periods. Investors can explore SOXS trading strategies on Tickeron.com.

AI Robots (Signal Agents)

APH / SOXS — Trading Results AI Trading Double Agent, 60min +113.85%

TSM / SOXS Trading Results AI Trading Double Agent, 60min +113.65%

QCOM / SOXS — Trading Results AI Trading Double Agent, 60min +113.30%

AI Robots (Virtual Agents)

Day Trader: Intraday AI Trading Agent with ETF Hedging, SOXS, and QID, 60 min +95.94%

Day Trader: Intraday AI Trading Agent with QID & SOXS Hedging, 60 min +95.94%

Day Trader: Intraday AI Trading Agent VOLATILITY EDGE, 60 min +95.94%

Tickeron’s AI Trading Agents: Revolutionizing Trading

Tickeron, a pioneer in AI-driven trading solutions, has transformed the way investors approach the market with its advanced Financial Learning Models (FLMs) and new AI Trading Agents operating on 15-minute and 5-minute time frames. These agents, available at Tickeron.com, offer unparalleled precision in identifying trading opportunities, particularly in volatile stocks like Wolfspeed.

How Tickeron’s FLMs Work

Tickeron’s FLMs analyze vast datasets, including price action, volume, news sentiment, and macroeconomic indicators, to detect patterns and generate real-time trading signals. By reducing the machine learning cycle from 60 minutes to as low as 5 minutes, Tickeron’s AI Agents adapt more dynamically to intraday market changes, delivering faster entry and exit signals. Backtests show these shorter time frames improve trade timing, with some agents achieving annualized returns of +151% on single-ticker strategies.

Trading WOLF with Tickeron’s AI Agents

For WOLF, Tickeron’s AI Agents could have capitalized on the recent short squeeze by identifying high-volume breakouts and momentum shifts. The 15-minute agent, for instance, excels at capturing short-term swing setups, as demonstrated by its +147% annualized return on Marvell Technology. Investors trading WOLF can leverage these agents to optimize entries during pullbacks or exits at resistance levels, enhancing returns while managing risk.

Inverse ETF Strategies with Tickeron

Tickeron’s AI Agents are particularly effective when trading inverse ETFs like SOXS. By analyzing anti-correlated assets, the agents can recommend hedged positions to protect against sector downturns. For example, during periods of semiconductor weakness, an AI Agent might suggest a long position in SOXS alongside a reduced WOLF holding, balancing potential losses. These strategies are accessible to both retail and institutional investors through Tickeron’s platform, democratizing sophisticated trading tools.

AI-Driven Trading: Tickeron’s Role in Market Success

The rise of AI in financial markets has leveled the playing field, and Tickeron is at the forefront of this revolution. Its AI Trading Agents, powered by FLMs, offer a competitive edge by processing market data faster and more accurately than traditional methods. On July 1, 2025, Tickeron reported that its new agents achieved win rates exceeding 85% on high-liquidity tickers, a testament to their robustness.

Why Choose Tickeron?

Tickeron’s platform, available at Tickeron.com, provides real-time data analysis, pattern recognition, and predictive analytics tailored to individual investor needs. Whether trading WOLF, SLAB, or SOXS, users can access customized strategies that adapt to market conditions. The platform’s user-friendly interface and institutional-grade tools make it a go-to resource for traders seeking to capitalize on opportunities like Wolfspeed’s recent surge.

Is There Potential for Further Growth?

Despite its remarkable rally, Wolfspeed’s growth potential hinges on several factors:

Bullish Case

- Restructuring Success: If Wolfspeed emerges from bankruptcy by Q3 2025 with a leaner balance sheet, it could attract new institutional investors, driving further upside.

- SiC Demand: The secular growth trend in SiC applications, particularly in EVs (projected to grow at a 25% CAGR through 2030), supports Wolfspeed’s revenue trajectory.

- Short Interest: Persistent short interest could fuel additional squeezes if positive catalysts, such as better-than-expected earnings, emerge.

Bearish Case

- Earnings Pressure: The projected EPS decline to -$0.70 in Q3 2025 may temper enthusiasm, especially if margins remain compressed.

- Overbought Conditions: An RSI of 82 suggests the stock is overbought, increasing the risk of a near-term pullback.

- Market Volatility: Trump’s tariff policies and macroeconomic uncertainties could disrupt semiconductor supply chains, impacting Wolfspeed’s operations.

Conclusion: Navigating Wolfspeed’s Next Chapter

Wolfspeed’s 483.15% surge over five trading days underscores the power of short squeezes, strategic restructuring, and leadership changes in driving stock price momentum. While the upcoming Q3 2025 earnings report presents challenges, the company’s focus on SiC innovation, capacity expansion, and financial restructuring positions it for long-term growth. Investors can enhance their strategies by tracking correlated stocks like SLAB, hedging with inverse ETFs like SOXS, and leveraging AI-driven tools from Tickeron.com. As Wolfspeed navigates its bankruptcy and capitalizes on the SiC market, its stock remains a high-risk, high-reward opportunity for savvy traders.

For the latest insights and AI-powered trading strategies, visit Tickeron.com.