Know Labs, Inc. (KNW), a company specializing in non-invasive diagnostic technology and recently pivoting to a Bitcoin treasury strategy, has captured significant investor attention in June 2025. With a staggering +738.71% gain this month and an average daily trading volume of 16 million shares, KNW has emerged as a focal point for traders and investors. This article provides an in-depth analysis of KNW’s recent stock performance, key market news as of June 16, 2025, comparisons with correlated stocks, trading strategies involving inverse ETFs, and the role of Tickeron’s AI tools in navigating this volatile stock. All data and insights are drawn from market trends, posts on X, and resources available at Tickeron.com.

Unprecedented Stock Performance in June 2025

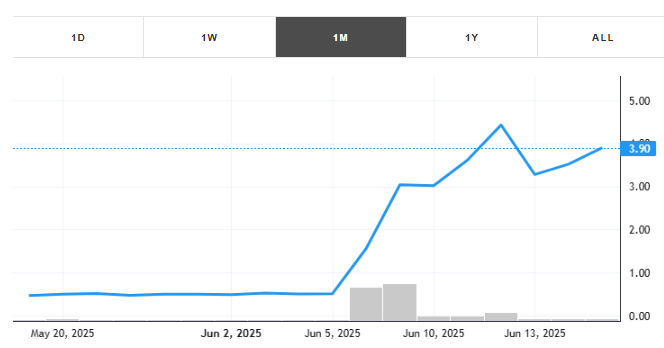

KNW’s stock has experienced an extraordinary surge in June 2025, gaining +738.71% month-to-date with an average daily trading volume of 16 million shares. As of June 17, 2025, the stock was trading at approximately $4.00, a dramatic increase from its low of $0.33 earlier in the year, as noted in posts on X. This meteoric rise is attributed to a combination of strategic corporate developments and speculative fervor. On June 12, 2025, the 10-day moving average for KNW crossed bullishly above the 50-day moving average, signaling a strong upward trend. Additionally, the Momentum Indicator moved above the 0 level on the same day, suggesting continued upward momentum in 87 of 92 past instances. However, the 10-day RSI Indicator moved out of overbought territory on June 13, 2025, hinting at a potential pullback, which traders should monitor closely.

Market Context on June 16, 2025

On June 16, 2025, broader market dynamics provided a backdrop for KNW’s performance. The S&P 500, tracked by the SPDR S&P 500 ETF Trust (SPY), was navigating volatility influenced by positive U.S.-China trade developments and escalating geopolitical tensions in the Middle East. SPY futures were down 0.56% on June 12, 2025, reflecting cautious sentiment. Meanwhile, technology stocks, particularly those with AI and cryptocurrency exposure, saw heightened interest. For instance, GitLab Inc. (GTLB) gained +6.29% over the five trading days ending June 8, 2025, driven by AI integration and strong earnings expectations. KNW’s Bitcoin pivot aligns with this trend, as investors eye companies leveraging cryptocurrency strategies, similar to the tech sector’s AI-driven rally in April 2025.

Comparison with a Correlated Stock: GitLab Inc. (GTLB)

To contextualize KNW’s performance, it’s useful to compare it with GitLab Inc. (GTLB), a stock with high correlation due to its technology-driven business model and AI integration. As of June 8, 2025, GTLB gained +6.29% over five trading days, with an average daily volume of 289,842 shares, driven by positive sentiment around its AI-driven product enhancements. While GTLB’s growth is more stable, with a +25.7% year-over-year revenue increase and a $1.1 billion cash reserve, KNW’s +738.71% monthly gain reflects speculative fervor tied to its Bitcoin strategy rather than fundamental stability. Both companies benefit from the broader AI and tech rally, but KNW’s higher volatility and smaller float (4.8 million shares) amplify its price swings compared to GTLB’s more measured growth. Investors can explore GTLB’s performance further at Tickeron’s GTLB page.

Trading KNW with Inverse ETFs

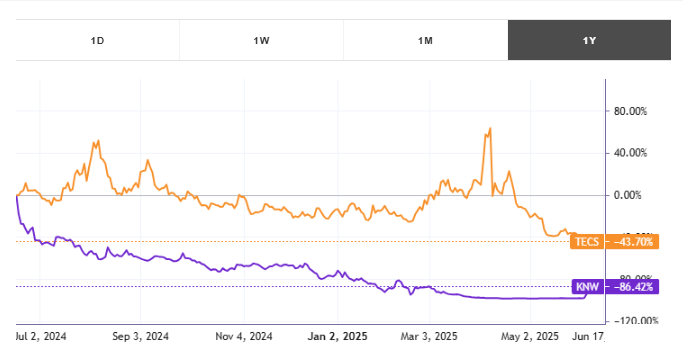

For traders seeking to manage KNW’s volatility, pairing it with an inverse ETF like the Direxion Daily Technology Bear 3X ETF (TECS) can be a strategic approach. TECS, which exhibits a strong negative correlation with technology-heavy stocks, aims to deliver three times the inverse daily performance of the Technology Select Sector Index. On May 28, 2025, TECS’s Momentum Indicator moved above the 0 level, signaling potential upward movement in 77 of 92 past instances, making it a candidate for hedging against KNW’s potential pullbacks. For example, if KNW’s RSI of 94 indicates overbought conditions and a potential correction to $3.20–$2.80, as suggested on June 11, 2025, traders could take a long position in TECS to offset losses. This strategy allows traders to balance bullish exposure to KNW with bearish protection, leveraging Tickeron’s AI tools to time entries and exits effectively.

Leveraging Tickeron’s AI Trading Agents

Tickeron’s Financial Learning Models (FLMs), led by CEO Sergey Savastiouk, have revolutionized trading by integrating AI with technical analysis. For a volatile stock like KNW, Tickeron’s AI Trading Robots and Double Agents offer critical insights. These tools analyze real-time market patterns, identifying bullish signals (e.g., KNW’s bullish moving average crossover on June 12, 2025) and bearish signals (e.g., RSI overbought at 94) to provide a balanced perspective. Tickeron’s user-friendly bots cater to beginners, while high-liquidity stock robots ensure efficient trade execution. Traders can access these tools at Tickeron’s Virtual Agents page, enabling precise decision-making in KNW’s fast-moving market. By simulating strategies based on historical data, Tickeron’s AI helps traders navigate KNW’s volatility, optimizing entries near support levels like $3.20 and exits near resistance at $5.00.

Risks and Outlook for KNW

Despite its impressive gains, KNW faces significant risks. The potential dilution from increasing the share count to over 350 million could pressure the stock, as highlighted on X. Additionally, the RSI of 94 suggests overbought conditions, with analysts shorting at $3.60 with targets at $3.20 and $2.80. Macroeconomic factors, such as inflation concerns and trade policy shifts, could also impact KNW’s trajectory, as seen in the broader market’s cautious sentiment on June 12, 2025. Looking ahead, KNW’s next catalysts include the Q3 CEO transition and Bitcoin acquisition, which could drive further gains if executed successfully. Traders should monitor Tickeron’s KNW page for real-time updates and AI-driven insights.

Industry description

This industry manufactures electronic products used in various critical and sophisticated technologies, including laser-based systems, circuit and continuity testers, electro-optical measuring instruments and high-speed precision weighing and inspection equipment. Some major companies operating in this business are Canon Inc., Keysight Technologies Inc., and Fortive Corp.

Market Cap

The average market capitalization across the Electronic Equipment/Instruments Industry is 5.99B. The market cap for tickers in the group ranges from 27.54K to 109.85B. KYCCF holds the highest valuation in this group at 109.85B. The lowest valued company is CSEC at 27.54K.

High and low price notable news

The average weekly price growth across all stocks in the Electronic Equipment/Instruments Industry was -2%. For the same Industry, the average monthly price growth was 13%, and the average quarterly price growth was 2%. KNW experienced the highest price growth at 29%, while TRCK experienced the biggest fall at -56%.

Volume

The average weekly volume growth across all stocks in the Electronic Equipment/Instruments Industry was -19%. For the same stocks of the Industry, the average monthly volume growth was 9% and the average quarterly volume growth was -33%

Fundamental Analysis Ratings

The average fundamental analysis ratings, where 1 is best and 100 is worst, are as follows

Valuation Rating: 51

P/E Growth Rating: 66

Price Growth Rating: 59

SMR Rating: 73

Profit Risk Rating: 77

Seasonality Score: 7 (-100 … +100)

Conclusion

Know Labs, Inc. (KNW) has emerged as a high-octane stock in June 2025, driven by its Bitcoin treasury pivot and biometric RFID advancements. Its +738.71% monthly gain and 16 million average daily trading volume underscore its speculative appeal, but risks like dilution and overbought conditions warrant caution. By comparing KNW to correlated stocks like GTLB, leveraging inverse ETFs like TECS, and utilizing Tickeron’s AI Trading Robots, traders can navigate this volatility with greater precision. For the latest insights and trading strategies, visit Tickeron.com and Tickeron’s KNW page.