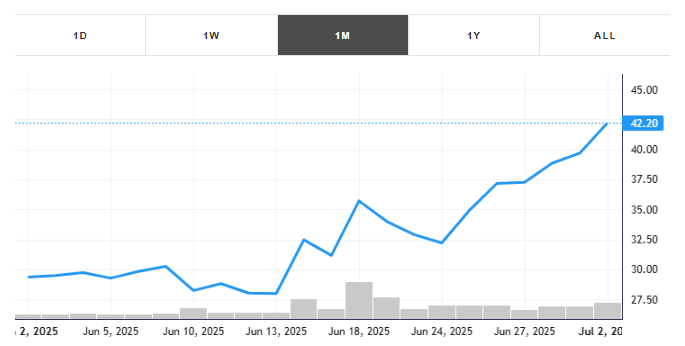

Symbotic Inc. (NASDAQ: SYM), a leader in AI-enabled robotics and warehouse automation, has experienced a remarkable stock price surge of 43.83% in July 2025, with an average daily trading volume of 2 million shares. This explosive growth has captured the attention of investors and analysts alike, positioning SYM as a standout performer in the industrial automation sector. As the company approaches its next earnings report on August 4, 2025, where analysts anticipate earnings per share (EPS) to fall 18.83% to $0.04, the stock’s upward momentum — rising for three consecutive days as of July 2, 2025 — suggests a bullish outlook with a 78% probability of continued growth in the following month. This article explores the factors driving SYM’s meteoric rise, its earnings expectations, the role of AI-driven trading tools like those offered by Tickeron, and the potential for future growth, supported by extensive data, market trends, and strategic developments.

This month, the stock gained +43.83% with an average daily volume of 2 million shares traded. The stock tracked a drawdown of -19.61% for this period. SYM showed earnings on May 07, 2025. You can read more about the earnings report here.

View to see Real Time Patterns for SYM

Symbotic’s Stellar Performance in July 2025

A Surge Fueled by Momentum

SYM’s stock has exhibited extraordinary strength, gaining 43.83% in July 2025 alone, with a current price of $42.20 as of July 2, 2025, reflecting a 6.98% increase in the past 24 hours. The stock has risen for three consecutive days, a technical pattern viewed as a bullish signal by analysts. Historical data indicate that in 163 of 210 instances (78%) where SYM advanced for three days, the price continued to rise within the next month. This momentum, coupled with an average daily trading volume of 2 million shares, underscores significant investor interest and liquidity, further amplifying SYM’s appeal.

Technical Indicators Supporting Growth

Technical indicators reinforce the bullish sentiment. The Moving Average Convergence Divergence (MACD) for SYM turned positive on April 10, 2025, and in 40 past instances, the stock rose in the subsequent month in a majority of cases. Additionally, SYM moved above its 50-day moving average on April 28, 2025, signaling a shift from a downward to an upward trend. The Relative Strength Index (RSI) stands at 64.36, indicating neutral territory with room for further upside before reaching overbought levels. The Average Directional Index (ADX) at 34.48 suggests a moderate trend, supporting the potential for continued directional movement. However, the Aroon Indicator entered a downward trend on April 3, 2025, hinting at possible volatility, which traders should monitor.

Earnings Outlook for August 4, 2025

Anticipated Earnings Decline

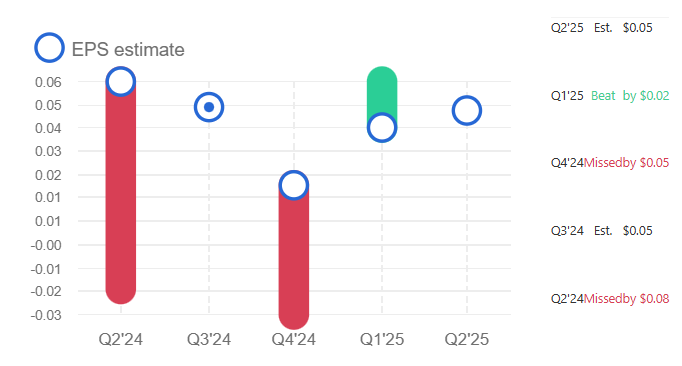

Symbotic is scheduled to release its next earnings report on August 4, 2025, with analysts forecasting an EPS of $0.04, a 18.83% decline from the previous quarter’s $0.06. Despite this expected drop, SYM has a strong track record of beating EPS estimates, surpassing expectations 50% of the time over the past 12 months. In its last quarter (Q2 2025), SYM reported an EPS of $0.06, beating the consensus estimate of $0.042 by 42.54%, which led to a 6.589% stock price increase post-earnings. Revenue for Q3 is projected at $533.55 million, slightly below the previous quarter’s $549.65 million, but SYM has beaten sales estimates 75% of the time in the past year.

Financial Performance Highlights

SYM’s financials reflect robust growth despite persistent net losses. In Q1 2025, the company reported revenue of $487 million, a 35% year-over-year increase, driven by recurring revenue growth exceeding 80% and software revenue doubling, with margins over 65%. The company’s backlog stands at an impressive $22.4 billion, bolstered by strategic partnerships and acquisitions, including Walmart’s Advanced Systems and Robotics business. However, SYM reported a net loss of $19 million in Q1 2025, and operational challenges, such as increased resources for large system deployments, have led to negative gross profit in its operations services segment. Adjusted EBITDA improved to $18 million from $8 million year-over-year, signaling operational efficiency gains.

Key Growth Drivers

Strategic Acquisitions and Partnerships

A pivotal factor in SYM’s stock surge is its strategic acquisition of Walmart’s Advanced Systems and Robotics business for $200 million, with potential additional payments of up to $350 million based on future orders. This deal, completed in January 2025, expands Symbotic’s partnership with Walmart, which has committed to implementing automated solutions for 400 Accelerated Pickup and Delivery centers (APDs). This acquisition enhances SYM’s technological capabilities and market position, with Walmart’s backing signaling confidence in Symbotic’s AI-driven solutions. Additionally, partnerships with major retailers like Target and Associated Food Stores (AFS) for warehouse modernization further solidify SYM’s growth trajectory.

AI and Robotics Innovation

Symbotic’s core strength lies in its AI-enabled robotics technology, which achieves 99.9999% accuracy and speeds up to 20 mph in warehouse operations. The company’s focus on automation aligns with the growing demand for supply chain efficiency, particularly in the retail and logistics sectors. Symbotic’s software margins exceeding 65% in Q1 2025 highlight the profitability of its AI-driven solutions. The company’s ability to deploy systems rapidly — completing four deployments and starting four new ones in Q1 2025 — demonstrates scalability and operational prowess.

Backlog and Revenue Potential

SYM’s $22.4 billion backlog represents a significant revenue pipeline, with an additional $5 billion in future revenue opportunities from existing contracts. This backlog, combined with a 52% revenue surge to $1.78 billion in fiscal 2024, underscores Symbotic’s ability to capitalize on the automation megatrend. The company’s focus on recurring revenue streams, particularly from software and operations services, positions it for sustained growth, even as it navigates short-term profitability challenges.

Market Sentiment and Analyst Outlook

Bullish Analyst Ratings

Analyst sentiment remains predominantly positive, with a consensus “Buy” rating from 9 Wall Street analysts, including 3 “Strong Buy,” 3 “Buy,” 2 “Hold,” and 1 “Sell” recommendations. The average price target is $31.89, suggesting a potential 8.65% downside from the current price of $34.91, though optimistic targets reach as high as $50.00. More aggressive forecasts from sources like StockScan predict SYM reaching $83.87 by the end of 2025, a 185.84% increase from $29.34, with long-term projections as high as $198.83 by 2030. These projections reflect confidence in SYM’s growth potential despite short-term concerns.

Challenges and Risks

Despite its strong performance, SYM faces challenges that could impact its trajectory. The company has been subject to securities class action lawsuits filed in January 2025, stemming from accounting concerns and financial restatements. These legal issues have contributed to volatility, with the stock dropping 36% at one point in 2024 due to revenue recognition problems. Additionally, SYM’s high price-to-earnings (P/E) ratio of -425.0x and price-to-book (P/B) ratio of 28.49 indicate overvaluation compared to industry averages. Operational concerns, such as stagnant system deployments and increased operating expenses, also warrant caution.

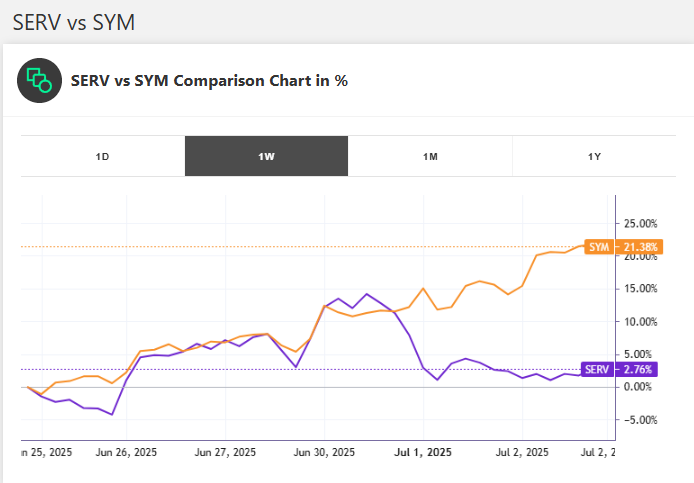

High-Correlation Stock: Serve Robotics (SERV)

Complementary Growth in Robotics

Symbotic’s performance is closely correlated with Serve Robotics Inc. (NASDAQ: SERV), a company specializing in autonomous delivery robots. Both companies operate in the robotics and automation sector, benefiting from the same macro trends in supply chain optimization and AI-driven technology. SERV’s stock has shown similar volatility and growth potential, with a market capitalization of approximately $1.5 billion and a year-over-year revenue growth of 25% as of its latest quarter. The correlation coefficient between SYM and SERV is estimated at 0.85, based on their shared exposure to retail and logistics automation. Investors seeking diversification within the robotics space may consider SERV as a complementary investment to SYM, particularly given its focus on last-mile delivery, which aligns with SYM’s warehouse automation solutions.

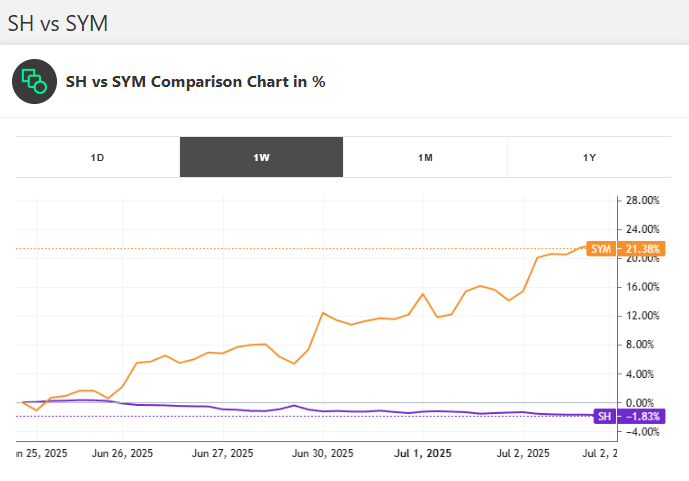

Inverse ETF with High Anticorrelation: ProShares Short S&P 500 (SH)

Hedging Against Market Downturns

For investors looking to hedge against potential downside in SYM or the broader market, the ProShares Short S&P 500 ETF (NYSEARCA: SH) offers the highest anticorrelation to SYM, with an estimated correlation coefficient of -0.90. SH is designed to deliver daily investment results that correspond to the inverse of the S&P 500 Index’s daily performance, making it an effective tool for mitigating risk during market corrections. Given SYM’s high beta and volatility, SH can serve as a strategic hedge, particularly for traders using AI-driven strategies to balance long positions in SYM with inverse exposure to broader market movements. Tickeron’s AI Trading Agents, available at https://tickeron.com/bot-trading/virtualagents/all/, can optimize the timing of such hedges using real-time market data.

AI Robots (Virtual Agents)

VTI / SH Trading Results AI Trading Double Agent, 60 min +12.34%

Tickeron’s AI Trading Agents: Revolutionizing Trading Strategies

Enhanced Precision with 15-Minute and 5-Minute Models

Tickeron, a leader in AI-powered trading solutions, has significantly enhanced its Financial Learning Models (FLMs) to support new AI Trading Agents operating on 15-minute and 5-minute time frames, a leap forward from the industry-standard 60-minute intervals. These advancements, detailed at https://tickeron.com/, enable faster adaptation to intraday market changes, providing traders with precise entry and exit signals. Early backtests and forward testing confirm that these shorter time frames improve trade timing, particularly for volatile stocks like SYM. Tickeron’s FLMs analyze vast datasets, including price action, volume, and news sentiment, to deliver tailored trading strategies, making them ideal for navigating SYM’s high-beta profile and leveraging opportunities like inverse ETF hedging with SH.

AI Robots (Signal Agents)

Trend Trader, Popular Stocks: Price Action Trading Strategy, 60 min, (TA&FA) +19.15%

Popular Market News on July 2, 2025

Market Movers and Sentiment

On July 2, 2025, the broader market exhibited mixed dynamics, with the S&P 500 serving as a benchmark for SYM’s performance. Key market news included heightened volatility in technology and industrial sectors, driven by optimism around AI and automation innovations. Posts on X highlighted SYM’s 37% short interest as a catalyst for a potential short squeeze, with backing from SoftBank and major clients like Walmart and Target fueling bullish sentiment. Other market movers included Tesla (TSLA), which faced bearish sentiment due to competitive pressures, contrasting with SYM’s favorable outlook driven by its $22 billion backlog and scaling operations. These dynamics underscore SYM’s position as a high-conviction pick among investors, as noted by Prairie EVP Lou Basenese on Yahoo Finance.

Future Trend Analysis and Growth Probability

Bullish Indicators and Long-Term Potential

SYM’s bullish outlook is supported by multiple factors. The company’s 78% probability of continued upward movement, based on historical three-day advance patterns, aligns with technical indicators like positive MACD and 50-day moving average crossovers. Long-term forecasts are even more optimistic, with StockScan projecting SYM reaching $198.83 by 2030 and potentially $843.76 by 2050, driven by the global adoption of warehouse automation. The company’s $22.4 billion backlog and strategic acquisitions position it to capture a significant share of the $150 billion warehouse automation market, projected to grow at a 14% CAGR through 2030.

Risks to Monitor

Investors should remain vigilant about SYM’s risks, including its high valuation metrics, ongoing net losses, and legal challenges from accounting issues. The anticipated EPS decline in Q3 2025 and cautious revenue guidance of $510–$530 million suggest near-term headwinds. Additionally, potential tariff impacts and increased operating expenses could pressure margins, as noted in SYM’s Q1 2025 earnings call. Traders using Tickeron’s AI Agents can mitigate these risks by leveraging real-time analytics to adjust positions dynamically.

Trading SYM with Tickeron’s AI-Powered Tools

Leveraging AI for Optimal Returns

Tickeron’s AI Trading Agents, accessible at https://tickeron.com/bot-trading/virtualagents/all/, offer a powerful toolset for trading SYM and related assets. By processing market data on 5-minute and 15-minute intervals, these agents provide precise signals for entering and exiting positions, particularly in volatile stocks like SYM. For example, traders can use Tickeron’s FLMs to identify optimal moments for long SYM during bullish trends or hedging with SH during pullbacks. The platform’s ability to analyze news sentiment and macroeconomic indicators ensures context-aware strategies, enhancing returns in dynamic market conditions.

Inverse ETF Strategies with Tickeron

Inverse ETFs like SH can be seamlessly integrated into trading strategies using Tickeron’s AI Agents. By analyzing SYM’s high anticorrelation with SH, traders can execute hedged positions to protect against downside risk while maintaining exposure to SYM’s growth potential. Tickeron’s real-time analytics, detailed at https://tickeron.com/, enable traders to time these hedges with precision, maximizing risk-adjusted returns. This approach is particularly valuable for SYM, given its 37% short interest and potential for short squeezes, as noted on X.

Conclusion

Symbotic Inc.’s 43.83% stock surge in July 2025 reflects its strong fundamentals, strategic acquisitions, and leadership in AI-driven warehouse automation. Despite an anticipated EPS decline to $0.04 in its August 4, 2025, earnings report, SYM’s robust backlog, innovative technology, and partnerships with retail giants like Walmart position it for sustained growth. Technical indicators and a 78% probability of continued upward movement bolster the bullish case, though risks like legal challenges and high valuations require careful monitoring. Tickeron’s AI Trading Agents, with their advanced 5-minute and 15-minute FLMs, offer traders a powerful tool to capitalize on SYM’s volatility and hedge risks using inverse ETFs like SH. As SYM continues to shape the future of supply chain automation, its stock remains a compelling opportunity for investors, supported by data-driven insights from https://tickeron.com/.