These past five trading days, the ETF gained +14.62% with an average daily volume of 821097 shares traded. The ETF tracked a drawdown of -5.63% for this period.

Introduction to NVDL and Its Market Position

The GraniteShares 2x Long NVDA Daily ETF (NVDL) is an actively managed exchange-traded fund designed to deliver twice the daily percentage change of NVIDIA Corporation’s (NVDA) stock price, before fees and expenses. Launched to capitalize on NVIDIA’s dominance in the artificial intelligence (AI) and semiconductor sectors, NVDL uses financial instruments like swaps and options, alongside direct investments in NVDA stock, to achieve its leveraged exposure. With NVIDIA’s market capitalization reaching $3.46 trillion in June 2025 and its stock gaining 9.59% year-to-date, NVDL offers traders a high-risk, high-reward opportunity to amplify returns on NVIDIA’s performance. However, its non-diversified nature and leveraged structure make it suitable primarily for knowledgeable, active traders.

NVDL Momentum Indicator Turns Positive

On May 1, 2025, NVDL’s Momentum Indicator moved above the 0 level, signaling a potential shift to a new upward trend. Tickeron’s AI analyzed 36 similar instances, finding that in 30 cases, the stock continued to rise in the following month, suggesting an 83% probability of continued upward movement. Additionally, on May 12, 2025, NVDL’s 10-day moving average crossed bullishly above its 50-day moving average, reinforcing the buy signal. This technical strength aligns with NVIDIA’s bullish momentum, as its Aroon Indicator triggered a bullish signal on June 25, 2025, with the AroonUp line above 70 and AroonDown below 30, indicating a strong potential for continued gains.

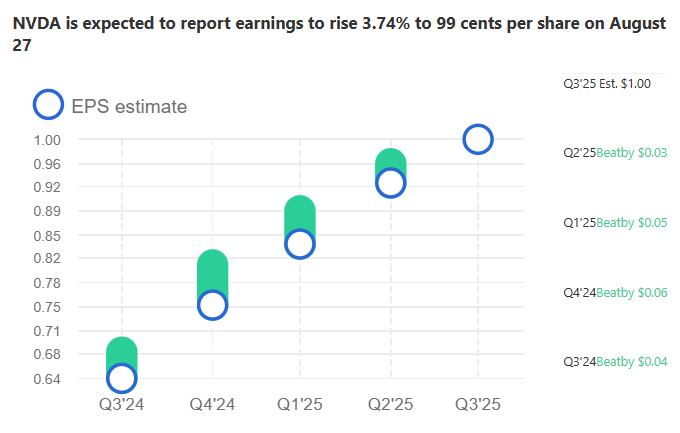

Earnings Impact and NVIDIA’s Performance

These past five trading days, the stock gained +7.32% with an average daily volume of 13 million shares traded. The stock tracked a drawdown of -2.85% for this period. NVDA showed earnings on May 28, 2025. You can read more about the earnings report here.

View to see Real Time Patterns for NVDA

While NVDL itself does not report earnings, its performance is directly tied to NVIDIA’s financial results. NVIDIA reported its Q1 2025 earnings on May 28, 2025, achieving a 70% year-over-year revenue growth, driven by robust demand for AI chips and gaming products. Analysts from Bank of America reiterated a “Buy” rating with a $190 price target, citing NVIDIA’s leadership in the AI data center market, projected to grow from $256 billion in 2025 to $823 billion by 2030. This growth trajectory supports NVDL’s potential, as its leveraged structure amplifies NVIDIA’s gains. Posts on X reflect strong retail sentiment, noting NVIDIA’s stock clearing resistance at $115 and approaching $124, with some predicting a run-up to $170 by year-end.

Market Movements on June 25, 2025

On June 25, 2025, the broader market showed mixed signals amid macroeconomic developments. The S&P 500 was flat, the Dow fell 0.25%, and the tech-heavy Nasdaq Composite gained 0.31%, driven by AI and tech momentum. NVIDIA’s stock hit a record high, reclaiming its position as the world’s most valuable company, fueled by AI optimism and a stable labor market. However, concerns about U.S. GDP contraction and potential Federal Reserve rate cuts starting in September introduced volatility. BlackRock’s Rick Rieder expressed confidence in equities, citing AI-driven inflation reduction as a bullish factor for the second half of 2025. These dynamics underscore NVDL’s appeal for traders seeking exposure to NVIDIA’s momentum in a volatile market.

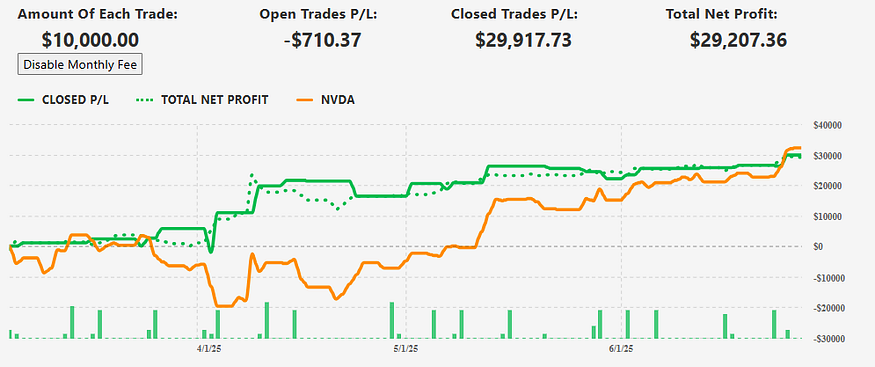

Tickeron’s AI Trading Agents and NVDL

Tickeron, a leader in AI-driven trading solutions, has enhanced its Financial Learning Models (FLMs) to launch new AI Trading Agents operating on 5- and 15-minute timeframes. These agents, available at Tickeron’s Virtual Agents page, analyze vast datasets — price action, volume, news sentiment, and macroeconomic indicators — to deliver precise trading signals. For NVDL, Tickeron’s Double Agent strategy, pairing NVDA with inverse ETFs like NVDS, achieved a +114% annualized return in 2025 using a 15-minute timeframe. These advancements allow traders to capitalize on NVDL’s rapid price movements while managing risks through hedging. Visit Tickeron.com for more details on these AI-powered tools.

NVDA

AI Robot’s NameP/L

NVDA / SOXS — Trading Results AI Trading Double Agent, 15min +304.39%

NVDA / NVDS Trading Results AI Trading Double Agent, 60 min +114.40%

Swing Trader, Popular Stocks: Price Action Trading Strategy — Pro Version (TA&FA), 60 min +17.01%

AI Robots and P/L

NVDA / NVDS Trading Results AI Trading Double Agent, 60 min +114.54%

Swing Trader: Search for Dips in Top 10 Giants (TA), 60 min +34.83%

Swing Trader: Tracking Dip Trends in Industrial Stocks (TA) — Trading Results, 60 min +15.84%

Trading NVDL with Inverse ETFs

Leveraged ETFs like NVDL carry significant risks due to their 2x exposure, making them prone to volatility and potential short-term pullbacks. Tickeron’s AI Trading Agents mitigate these risks by employing Double Agent strategies, pairing NVDL with inverse ETFs like the Direxion Daily Semiconductor Bear 3X Shares (SOXS). This approach allows traders to profit in both bullish and bearish conditions, as seen in Tickeron’s reported +250% to +362% annualized returns for similar strategies in June 2025. By leveraging FLMs, these agents adapt to market shifts, offering retail and institutional traders a data-driven edge. Explore these strategies at Tickeron’s trading platform.

Risks and Considerations

NVDL’s leveraged structure amplifies both gains and losses, with NVIDIA’s beta of 1.7 indicating higher volatility than the S&P 500. A drawdown of -43.43% in 2025 highlights the ETF’s risk profile. Overbought conditions, as indicated by NVIDIA’s Relative Strength Index (RSI) above 70 on June 26, 2025, suggest potential short-term profit-taking. Traders must also consider macroeconomic factors, such as tariffs and China restrictions, which could impact NVIDIA’s growth. Using Tickeron’s AI tools, available at Tickeron.com, can help navigate these risks through real-time analysis and hedging strategies.

Conclusion and Forecast

NVDL’s outlook for 2025 remains bullish, driven by NVIDIA’s leadership in AI and semiconductors, with analysts projecting a $225.65 price target for NVDA. The ETF’s positive momentum indicators and NVIDIA’s strong earnings support further upside, though traders should remain cautious of volatility and overbought signals. Tickeron’s AI Trading Agents, leveraging advanced FLMs, provide a powerful tool for optimizing NVDL trades, particularly through short-term strategies and inverse ETF hedging. As the AI sector continues to drive market momentum, NVDL offers a compelling opportunity for active traders, supported by cutting-edge AI tools at Tickeron.com.