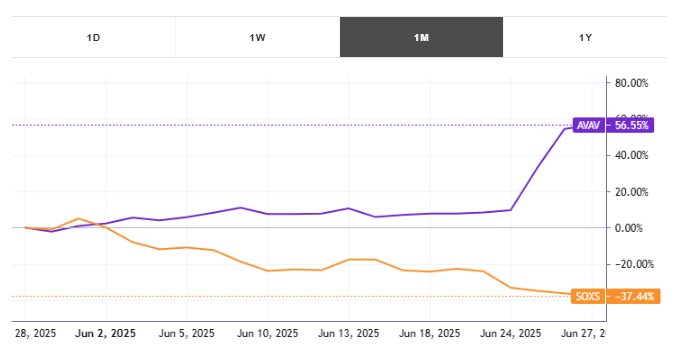

These past five trading days, the stock gained +43.43% with an average daily volume of 149076 shares traded.The stock tracked a drawdown of -8.98% for this period. AVAV showed earnings on June 24, 2025. You can read more about the earnings report here.

View to see Real Time Patterns for AVAV

AeroVironment’s Recent Performance Sparks Investor Optimism

AeroVironment, Inc. (NASDAQ: AVAV), a leading aerospace and defense company specializing in uncrewed aerial systems and loitering munitions, has seen its stock surge by an impressive 43.91% over the past five trading days, closing at $237.27 on June 26, 2025, with an average daily trading volume of 149,112 shares. The stock has been in a robust 40.92% uptrend, rising for three consecutive days as of June 26, 2025, fueled by strong Q4 2025 earnings results and bullish market sentiment. With 68 days until its next earnings call on September 3, 2025, investors are closely watching whether AVAV can maintain its momentum.

Q4 2025 Earnings: A Record-Breaking Quarter

AeroVironment reported stellar Q4 2025 results on June 24, 2025, driving the recent stock rally. The company posted quarterly earnings per share (EPS) of $1.61, surpassing the Zacks Consensus Estimate of $1.44 by 11.81% and marking a significant 274% increase from the $0.43 reported in the year-ago quarter. Revenues reached $275.05 million, a 39.6% year-over-year increase, beating analyst expectations of $242.69 million by 12.88%. The company’s fiscal year 2025 revenue hit a record $821 million, up 14% from the prior year, with a funded backlog of $726 million, an 82% increase year-over-year. Total bookings for the fiscal year reached $1.2 billion, reflecting strong demand for AVAV’s autonomous systems.

The acquisition of BlueHalo, finalized on May 1, 2025, further strengthens AVAV’s position as a defense technology leader. The deal expands its portfolio with new products like the P550, JUMP 20x, and Red Dragon, aligning with growing global defense spending. However, full-year net income fell 27% to $43.6 million from $59.67 million, primarily due to $18.4 million in non-cash UGV goodwill impairment charges. Despite this, Q4 net income doubled to $16.7 million from $6.046 million the previous year.

Fiscal 2026 Guidance: Mixed Signals

AeroVironment’s fiscal 2026 guidance, issued alongside its Q4 results, has sparked mixed reactions. The company projects revenues between $1.9 billion and $2 billion, aligning closely with the consensus estimate of $1.98 billion. However, its adjusted EPS guidance of $2.80–$3.00 falls short of the consensus estimate of $3.72, signaling potential challenges in maintaining profitability margins. Adjusted EBITDA is expected to range between $300 million and $320 million, reflecting confidence in operational growth despite service margin declines reported in Q4 2025 (from 43.3% to 43.8% for product gross margins, but a 6% drop in service gross margins).

Analysts remain cautiously optimistic, with Raymond James reiterating a “Strong Buy” rating and raising its price target from $200 to $225, while BTIG increased its target to $300, citing AVAV’s robust backlog and strategic acquisitions. The average one-year price target from seven analysts is $201.75, suggesting a potential 14.97% downside from the current price of $237.27, though estimates range from $157.27 to $240.00. GuruFocus estimates a fair value of $169.25, indicating a possible 28.67% downside, highlighting valuation concerns.

Market Movements on June 27, 2025

The broader market on June 27, 2025, showed resilience, with the S&P 500 rising 0.6% to a new record of 6,177.14, driven by optimism around potential trade deals with China and other countries. The Nasdaq also approached record highs, supported by strength in the technology sector, particularly Nvidia’s 4% surge. Asian markets were mixed, with Japan’s Nikkei 225 climbing 1.43% to 40,150.79, while Australia’s S&P/ASX 200 fell 0.43% to 8,514.20. Investors are closely monitoring upcoming inflation data, which could influence Federal Reserve rate cut expectations, potentially impacting high-growth stocks like AVAV.

Defense technology stocks, including AVAV, have benefited from heightened geopolitical tensions, boosting demand for uncrewed systems. However, recent posts on X highlight concerns about reduced sales to Ukraine, which could temper AVAV’s growth outlook. Despite this, the company’s $1.2 billion in bookings and diversified portfolio mitigate these risks.

Tickeron’s AI Trading Agents: Revolutionizing Trading Strategies

Tickeron, a leader in AI-driven trading solutions, has enhanced its Financial Learning Models (FLMs), enabling the launch of new AI Trading Agents operating on 15-minute and 5-minute timeframes. These agents, accessible at Tickeron’s Virtual Agents page, analyze vast datasets — price action, volume, and news sentiment — to deliver precise trading signals. Unlike traditional 60-minute models, these shorter timeframes allow for faster adaptation to market volatility, achieving annualized returns of up to +270% in backtests. Tickeron’s AI-powered Double Agent strategies, paired with inverse ETFs like QID and SOXS, offer traders a competitive edge by hedging against downturns or capitalizing on sector weaknesses. For AVAV traders, these tools can navigate the stock’s volatility, especially with its recent 43.91% surge and upcoming earnings uncertainty.

SOXS

AI Robots (Signals Only)

APH / SOXS — Trading Results AI Trading Double Agent, 60min +113.85%

TSM / SOXS Trading Results AI Trading Double Agent, 60min +113.65%

QCOM / SOXS — Trading Results AI Trading Double Agent, 60min +113.30%

AI Robots (Virtual Accounts)

Day Trader: Intraday AI Trading Agent with ETF Hedging, SOXS, and QID, 60 min +95.94%

Day Trader: Intraday AI Trading Agent with QID & SOXS Hedging, 60 min +95.94%

Day Trader: Intraday AI Trading Agent VOLATILITY EDGE, 60 min +95.94%

Outlook for September 3, 2025 Earnings

With 68 days until AeroVironment’s Q1 2026 earnings call on September 3, 2025, analysts expect an EPS of $1.33, a 17.39% decline from the prior year’s $1.61. This anticipated drop reflects challenges in sustaining the profitability seen in Q4 2025, potentially due to integration costs from the BlueHalo acquisition and margin pressures. However, AVAV’s strong backlog and global demand for its autonomous systems suggest resilience. Investors can leverage Tickeron’s AI Trading Bots to monitor AVAV’s price action and optimize trading strategies, particularly using inverse ETFs to hedge against potential post-earnings volatility.

Conclusion: Balancing Growth and Valuation Risks

AeroVironment’s 43.91% stock surge reflects strong investor confidence following its record-breaking Q4 2025 performance and strategic expansion through the BlueHalo acquisition. However, the anticipated 17.39% EPS decline for Q1 2026 and valuation concerns, with a potential 14.97%–28.67% downside per analyst estimates, warrant caution. As market dynamics evolve, tools like Tickeron’s AI Trading Agents provide investors with real-time insights to navigate AVAV’s trajectory. With 68 days until the next earnings call, AVAV remains a compelling yet volatile opportunity in the defense technology sector.