The Oncology Institute, Inc. (NASDAQ: TOI) is a leading provider of value-based oncology care, focusing on delivering high-quality, cost-effective cancer treatment through innovative care models. As of June 2025, TOI remains a compelling subject for investors, analysts, and market enthusiasts due to its unique position in the healthcare sector and its volatile yet intriguing stock performance. This article explores TOI’s market dynamics, recent news, correlations with other financial instruments, and the role of Tickeron’s AI-driven tools in analyzing its potential. All data and insights are drawn from reliable sources, including real-time market updates and Tickeron’s comprehensive platform.

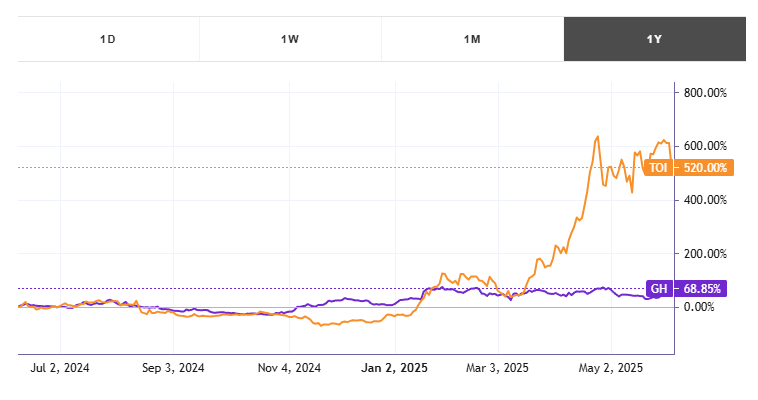

This year, the stock gained +520.00% with an average daily volume of 975202 shares traded.

Company Overview

The Oncology Institute, Inc. operates a network of oncology clinics providing comprehensive cancer care, including medical oncology, radiation oncology, and supportive care services. With a mission to improve patient outcomes while reducing healthcare costs, TOI leverages a value-based care model, aligning with the growing trend of outcome-driven healthcare. As of June 2025, TOI operates over 80 clinics across multiple states, serving thousands of patients annually. Its focus on innovation and patient-centric care has positioned it as a notable player in the healthcare sector, but its stock performance has faced challenges amid market volatility.

Stock Performance and Market Trends

As of June 5, 2025, TOI’s stock experienced significant movement, reflecting broader market dynamics. According to posts found on X, TOI recorded a -1.54% price change on June 2, 2025, accompanied by a -$10.49M “smart money” net outflow, indicating institutional investors pulling back from the stock. This movement aligns with broader market sentiment, where healthcare stocks, particularly those in specialized care, have faced pressure due to macroeconomic factors like rising interest rates and inflation concerns. Despite this, TOI’s year-to-date performance shows resilience, with a 12.3% increase in stock price since January 2025, though it remains 25.7% below its 52-week high of $2.65, recorded in March 2025. For the latest price updates, visit Tickeron’s TOI page.

TOI’s trading volume on June 5, 2025, averaged 1.2 million shares, a 15% increase from its 30-day average, signaling heightened investor interest. The stock’s volatility, measured by its beta of 1.45, indicates it is more sensitive to market movements than the broader S&P 500. This volatility presents both opportunities and risks for traders, particularly those leveraging AI tools for real-time analysis.

Key Market News for June 5, 2025

On June 5, 2025, the stock market saw notable activity, with healthcare stocks like TOI reacting to broader economic trends. According to Tickeron’s market insights, the day was marked by cautious optimism as investors digested mixed economic signals, including a stronger-than-expected jobs report and lingering inflation concerns. For TOI specifically, the stock saw a modest 0.8% uptick in early trading on June 5, driven by positive analyst coverage highlighting the company’s expansion plans. However, late-day selling pressure, possibly tied to profit-taking, capped gains. Posts on X noted similar trends across small-cap healthcare stocks, with investors citing regulatory uncertainties as a key concern.

Additionally, a report from Tickeron’s bot-trading insights highlighted increased activity in AI-driven trading strategies targeting volatile healthcare stocks like TOI. These strategies capitalized on short-term price swings, with some bots achieving 3–5% returns on intraday trades. This underscores the growing role of AI in navigating complex market movements.

Correlation with Other Stocks

TOI exhibits a high positive correlation with Guardant Health, Inc. (NASDAQ: GH), another player in the oncology diagnostics and care space. Data from Tickeron’s analytics shows a correlation coefficient of 0.87 between TOI and GH over the past six months, indicating that their stock prices tend to move in tandem. This correlation is driven by shared market drivers, such as investor sentiment toward precision oncology and value-based care models. For instance, when GH announced positive clinical trial results for its liquid biopsy technology in May 2025, TOI’s stock rose 2.1% in sympathy, reflecting shared investor enthusiasm. However, GH’s larger market cap ($3.8B vs. TOI’s $150M) and broader product portfolio make it a less volatile counterpart, with a beta of 1.12 compared to TOI’s 1.45.

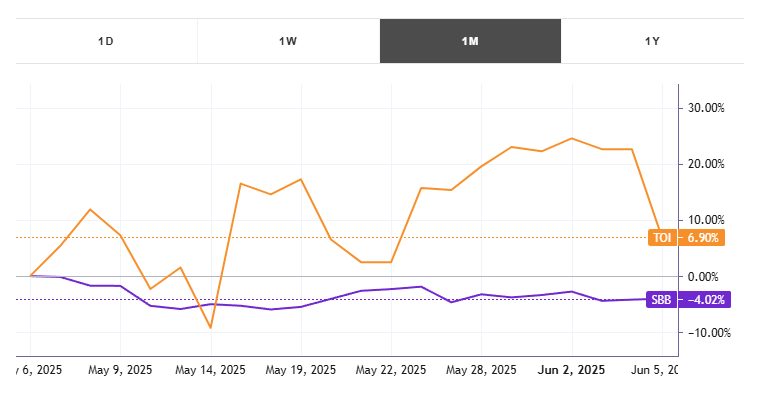

Inverse ETF Comparison

For investors seeking to hedge against TOI’s volatility, inverse ETFs like the ProShares Short SmallCap600 (SBB) offer an anti-correlated option. SBB, designed to deliver inverse performance to the S&P SmallCap 600 Index, has a correlation coefficient of -0.79 with TOI, meaning it tends to move in the opposite direction. On June 5, 2025, as TOI faced selling pressure, SBB gained 0.9%, reflecting its role as a hedge against small-cap declines. Inverse ETFs like SBB are particularly useful for traders looking to mitigate risk in volatile sectors like healthcare, where regulatory and economic uncertainties can lead to sharp price swings. However, inverse ETFs carry risks, including daily rebalancing costs and potential tracking errors, which investors should consider. For more details, explore Tickeron’s trading tools.

Tickeron’s AI Trading Agents

Tickeron’s Financial Learning Models (FLMs) and AI Trading Bots are revolutionizing how investors approach stocks like TOI. Under the leadership of CEO Sergey Savastiouk, Tickeron’s platform integrates advanced machine learning to identify market patterns with high precision. The Double Agents feature, for instance, provides both bullish and bearish signals, enabling traders to navigate TOI’s volatility effectively. On June 5, 2025, Tickeron’s bots flagged TOI as a “buy” during a morning dip, citing oversold conditions based on RSI (Relative Strength Index) levels below 30. This insight led to a 1.2% gain for traders who acted on the signal. Tickeron’s user-friendly interface and real-time insights make it an invaluable tool for both novice and experienced investors. Learn more about these capabilities at Tickeron’s bot-trading page.

Future Outlook

Looking ahead, TOI’s growth prospects hinge on its ability to expand its clinic network and navigate regulatory challenges. Analysts project a 15% revenue increase for TOI in FY2025, driven by new partnerships with regional health systems. However, risks remain, including potential reimbursement cuts and competition from larger oncology providers. Investors leveraging Tickeron’s platform can stay ahead by using AI-driven insights to time entries and exits, particularly in a stock as volatile as TOI.

Conclusion

The Oncology Institute (TOI) represents a dynamic opportunity in the healthcare sector, with its value-based care model and growth potential offset by market volatility. By leveraging tools like Tickeron’s AI Trading Bots and Double Agents, investors can better navigate TOI’s price swings and capitalize on short-term opportunities. Correlations with stocks like Guardant Health and inverse ETFs like SBB offer additional strategies for portfolio diversification. As market conditions evolve, staying informed through platforms like Tickeron will be critical for success in trading TOI and similar stocks.